Social media in fintech is a battlefield.

You’re competing for attention in an industry often seen as complex, dry, or—even worse—boring.

Moreover, audiences aren’t always quick to engage with brands in this space.

Unlike fashion or food, fintech isn’t inherently “social-friendly.”

Most fintech brands fail to grab their target market because their marketing is either too technical or too generic.

But if you want engagement, you need to get creative and craft a winning fintech social media marketing strategy.

With the right strategies, you can turn engagement into conversions and build a loyal customer base.

In this blog, we’ll share 12 powerful strategies that boost engagement and help you position your fintech brand as a leader in innovation.

If you want to streamline your efforts, social media management tools can help you schedule posts, track performance, and maintain a strong social media presence for fintech.

Power Up Your Fintech Socials With Social Champ!

Just like a solid fintech strategy, Social Champ delivers the numbers. Schedule smarter, engage better, and track it all!

Short Summary

- Social media marketing is essential for fintech brands to build trust, engage with customers, and generate leads.

- Fintech brands should focus on creating educational, simplified content to appeal to their audience.

- Influencer collaborations and video marketing are key strategies for boosting brand awareness and engagement.

- Engaging with niche communities and using data-driven insights can increase the effectiveness of marketing campaigns.

- Automation tools like Social Champ streamline social media marketing, allowing easy scheduling, analytics, and team collaboration.

- Choosing the right fintech social media tool is crucial for efficiency, with features like automation, security, and analytics being essential.

What Is Fintech Social Media Marketing & Why It’s a Game-Changer?

Fintech social media marketing isn’t just about having an online presence—it’s about using digital platforms to educate, engage, and convert your audience in a space where trust is everything.

Unlike traditional finance marketing, which relies heavily on credibility and compliance, social media for fintech demands connection and conversation.

Think about it. Finance has long been a world of stiff suits, legal disclaimers, and intimidating jargon.

But today’s audience—especially Millennials and Gen Z—expects a different experience.

They want simple, transparent, and even entertaining financial content.

They’re looking for brands that help them make sense of their money without the corporate fluff.

And that’s exactly why fintech social media marketing is a game-changer.

It allows your brand to:

- Humanize Finance: Break down complex financial topics into bite-sized, engaging content that feels approachable

- Build Trust & Authority: Share insights, case studies, and user-generated content to position yourself as a go-to fintech brand.

- Leverage Social Proof: Use testimonials, influencer partnerships, and customer success stories to reinforce credibility.

- Engage in Real-Time: Unlike traditional marketing, social media lets you answer questions, address concerns, and connect directly with your audience.

- Drive Conversions with Smart Targeting: Platforms like Instagram, LinkedIn, and X offer advanced targeting features that help you reach the right audience at the right time.

The bottom line? If you’re not prioritizing social media marketing in fintech, you’re missing out on one of the most powerful ways to grow your brand and engage your audience.

And with the right approach (and tools like Social Champ), you can turn social media into your most valuable marketing asset

Featured Article: Best Hashtags for TikTok to Go Viral in 2025: A Comprehensive List

12 Fintech Social Media Marketing Strategies to Drive Growth

Social media is one of the most powerful (yet underutilized) tools for fintech brands.

Here are 12 powerful FinTech social media marketing strategies that will help you turn your social media into a lead-generating engine, make your brand stand out, and build connections with your audience.

-

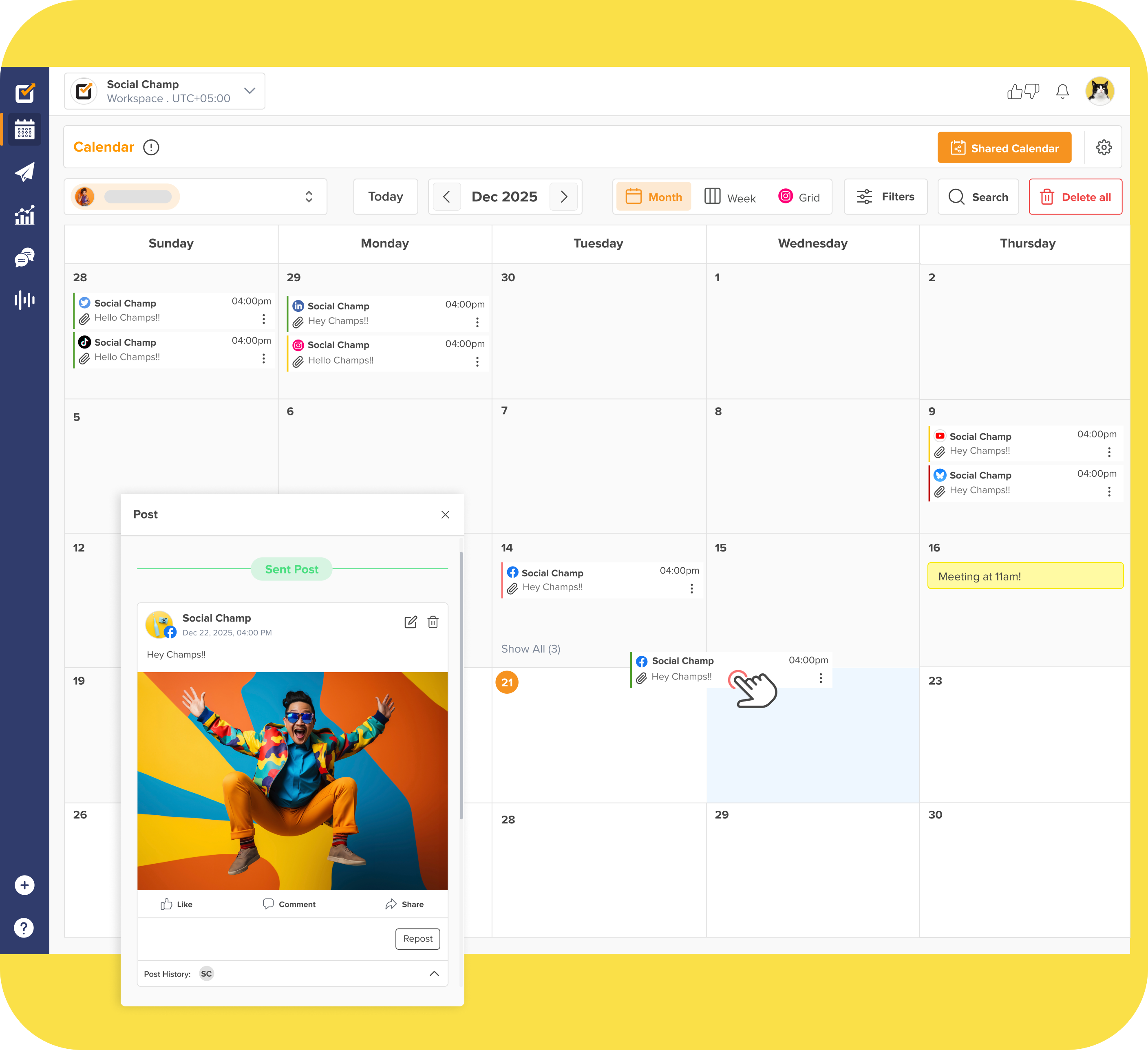

Design Content for the “Finance-Averse” Audience

Most people feel overwhelmed by finance.

They don’t want jargon-filled explanations—they want simple, actionable advice that lets them control their money.

Do This:

- Ditch the industry buzzwords. Speak in plain, conversational language.

- Use storytelling to show how your product solves real-world money problems.

- Create visual explainers (charts, short videos, infographics) that simplify complex topics like credit scores, investment risks, or DeFi.

Example: Instead of a post titled “Understanding Compound Interest”, try “How to Turn $100 into $1,000 Without Lifting a Finger.”

An Educational Carousel Post on Acecashexpress’s Instagram -

Use X & LinkedIn for Financial Thought Leadership

Fintech audiences don’t just want product updates; they want insights from industry leaders.

X and LinkedIn are prime platforms for fintech founders, CEOs, and CMOs to build credibility and authority.

Do This:

- Share hot takes on industry news and regulatory changes.

- Post data-driven insights.

- Engage with key fintech influencers & VCs to get on their radar.

Example: Instead of “New Feature Alert! Our app now supports crypto trading!” try “Traditional banks still take 3-5 days to process international transfers. Here’s how fintech is changing that (and why you should care).”

Thought Leadership Post on Ripple’s LinkedIn -

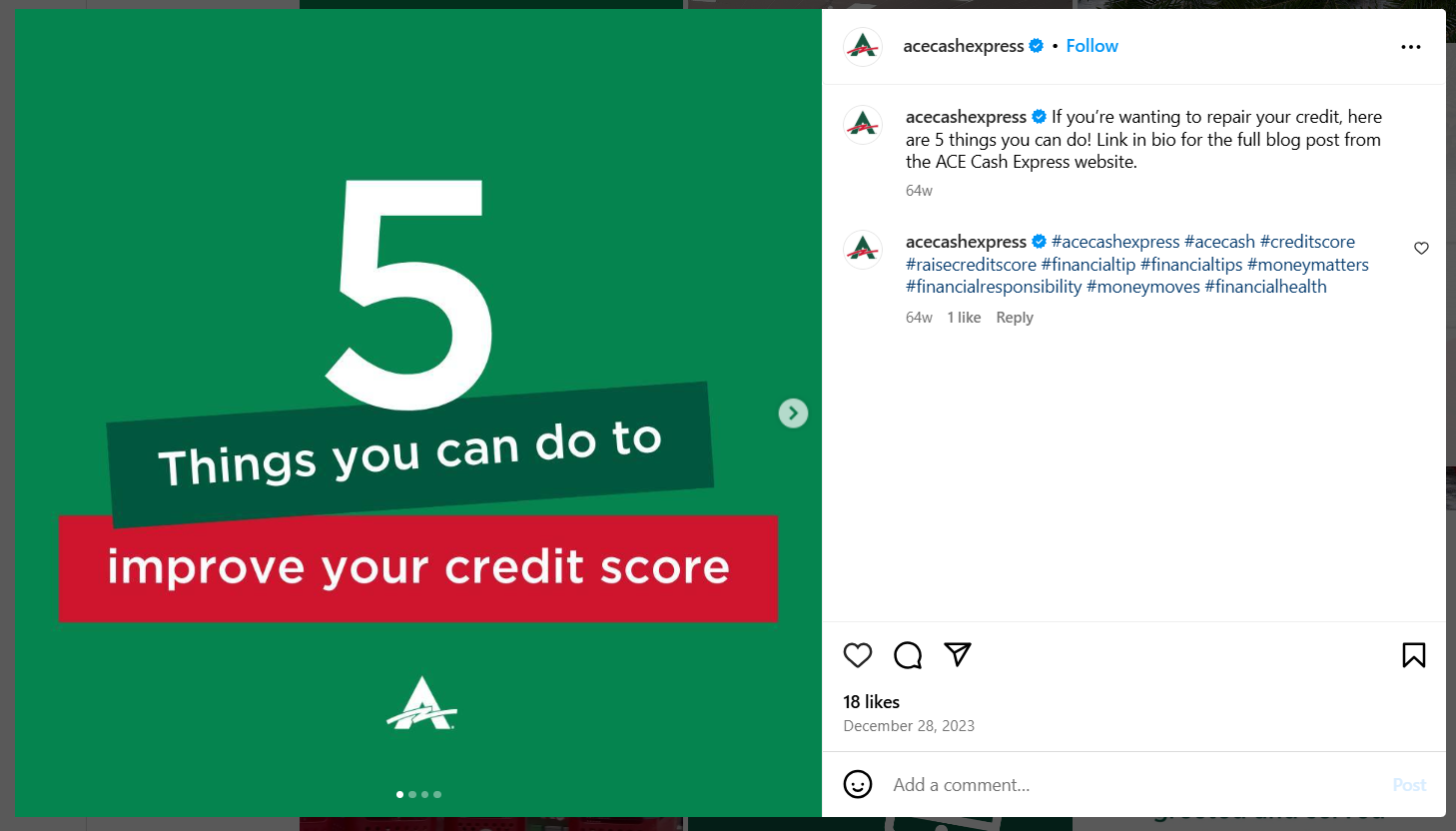

Show the Human Side of Your Fintech Brand

Finance is emotional—people associate it with security, aspirations, and even fear.

Showing the human side of your brand creates deeper connections.

Do This:

- Share the origin story of your fintech company—why it exists and who it helps.

- Highlight your team members, founders, and company culture to build trust.

- Feature behind-the-scenes moments (product dev insights, hiring updates, company wins).

Example: Post an Instagram reel about how your team manages workload, or maybe introduce interns, etc.

The Ayden Formula Series on Ayden’s YouTube -

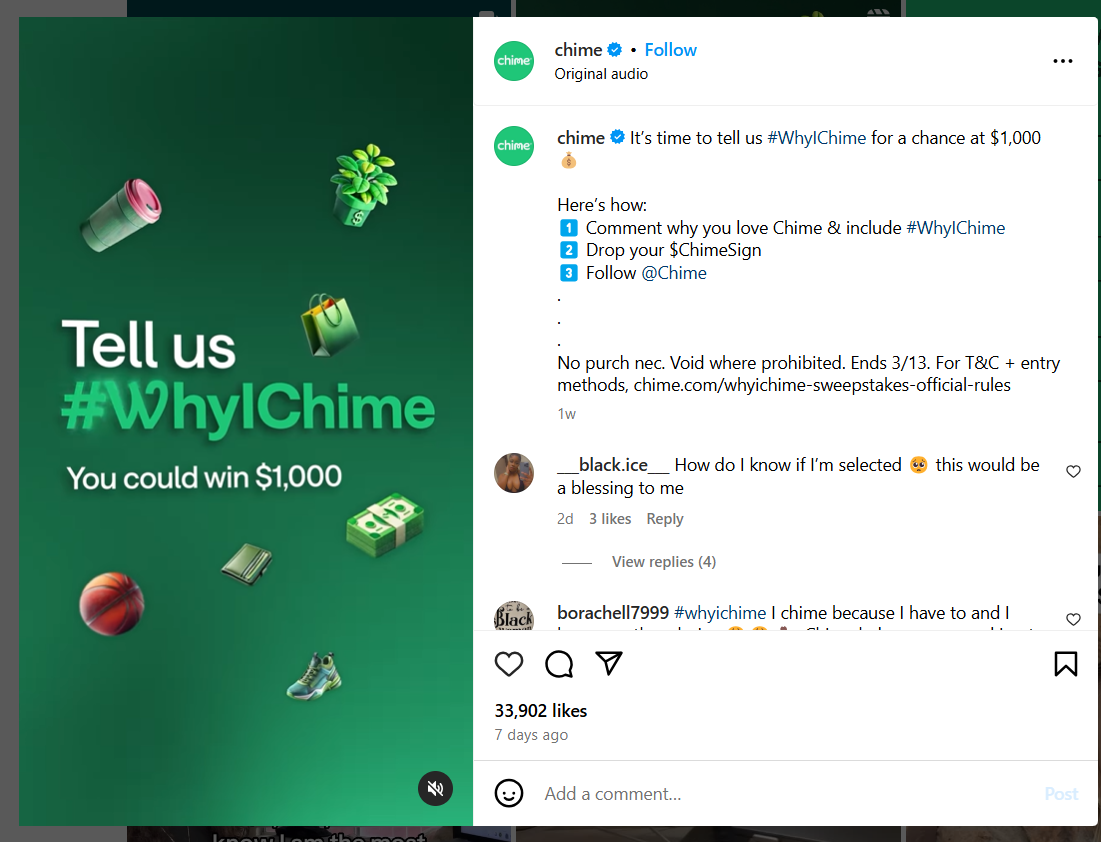

Convert Customers Into Brand Ambassadors

People love sharing content that makes them look smart or ahead of the curve.

If your fintech brand gives them insider knowledge or exclusive benefits, they’ll spread the word for you.

Do This:

- Offer early access to new features in exchange for social shares.

- Create exclusive finance tips only available in your community.

- Reward user-generated content (UGC) with cashback, discounts, or VIP access.

Example: If your app helps people invest, run a challenge: “Share your best investment tip in 10 words or less. Best responses get $25 in free stock.”

An Instagram Post of Giving Rewards to the User-Generated Content -

Leverage Data-Driven Personalization

People engage more with content that feels tailored to them.

Instead of posting generic finance tips, segment your audience and personalize your content.

Do This:

- Use polls & interactive stories to gather audience insights.

- Personalize content for different fintech users (investors, small business owners, freelancers).

- Use AI-powered tools like Social Champ to schedule posts at the most engaging times for different audience segments.

Example: If 70% of your users are freelancers, create a weekly “Freelancer Finance Friday” series with tips on taxes, invoicing, and budgeting.

-

Create “Ask Me Anything” (AMA) Sessions

People have a million questions about money, but don’t know where to ask them.

Hosting AMA sessions positions your brand as an approachable finance expert.

Do This:

- Pick a specific finance topic (e.g., “Ask me anything about crypto taxes”).

- Promote the AMA on all your channels a few days before.

- Engage in real-time discussions and share key takeaways afterward.

Example: A digital bank can host a “Small Business Banking AMA” to discuss challenges like cash flow management and loan approvals.

-

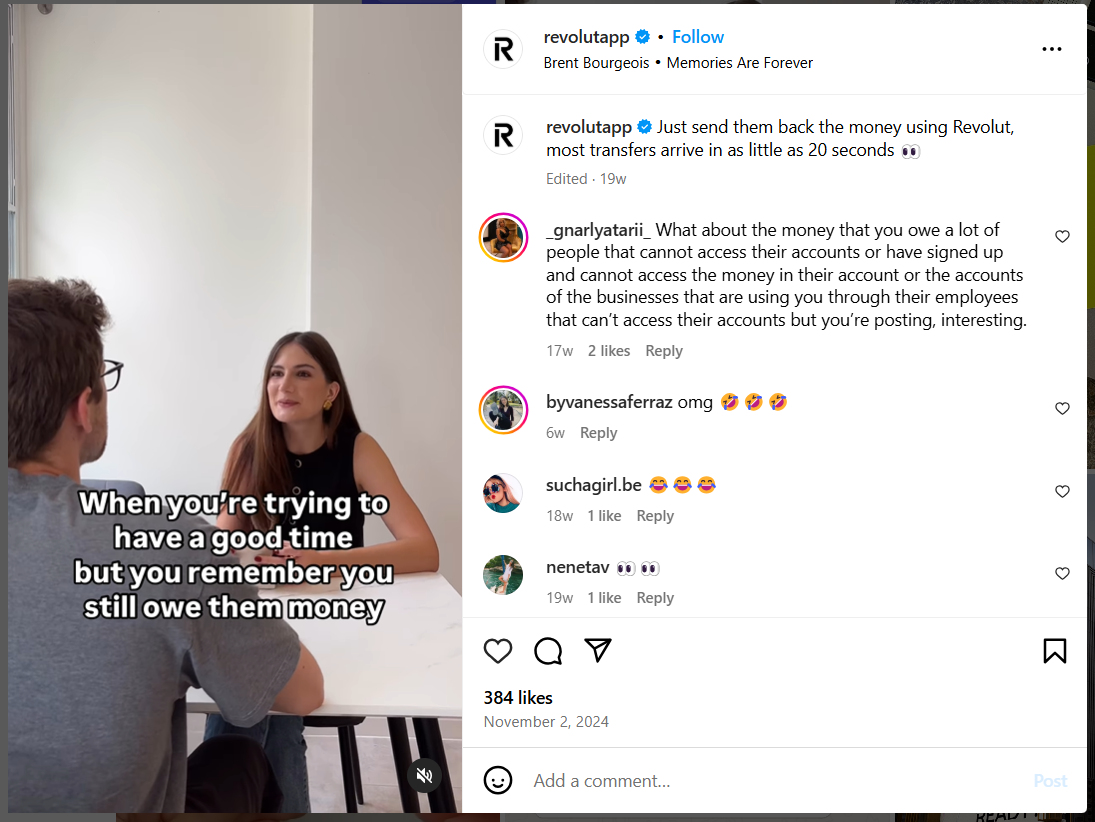

Make Your Content “Meme-Worthy” (Without Losing Credibility)

Finance is serious, but your social media presence shouldn’t be boring.

Smart, well-timed memes and pop culture references can boost engagement and even make your brand go viral while keeping things relatable.

Do This:

- Use trending finance memes with a fintech spin.

- Pair memes with educational insights to keep credibility intact.

Example: Instead of a dry post about inflation, try a funny meme to show it.

Revoult App Sharing Memes on Instagram -

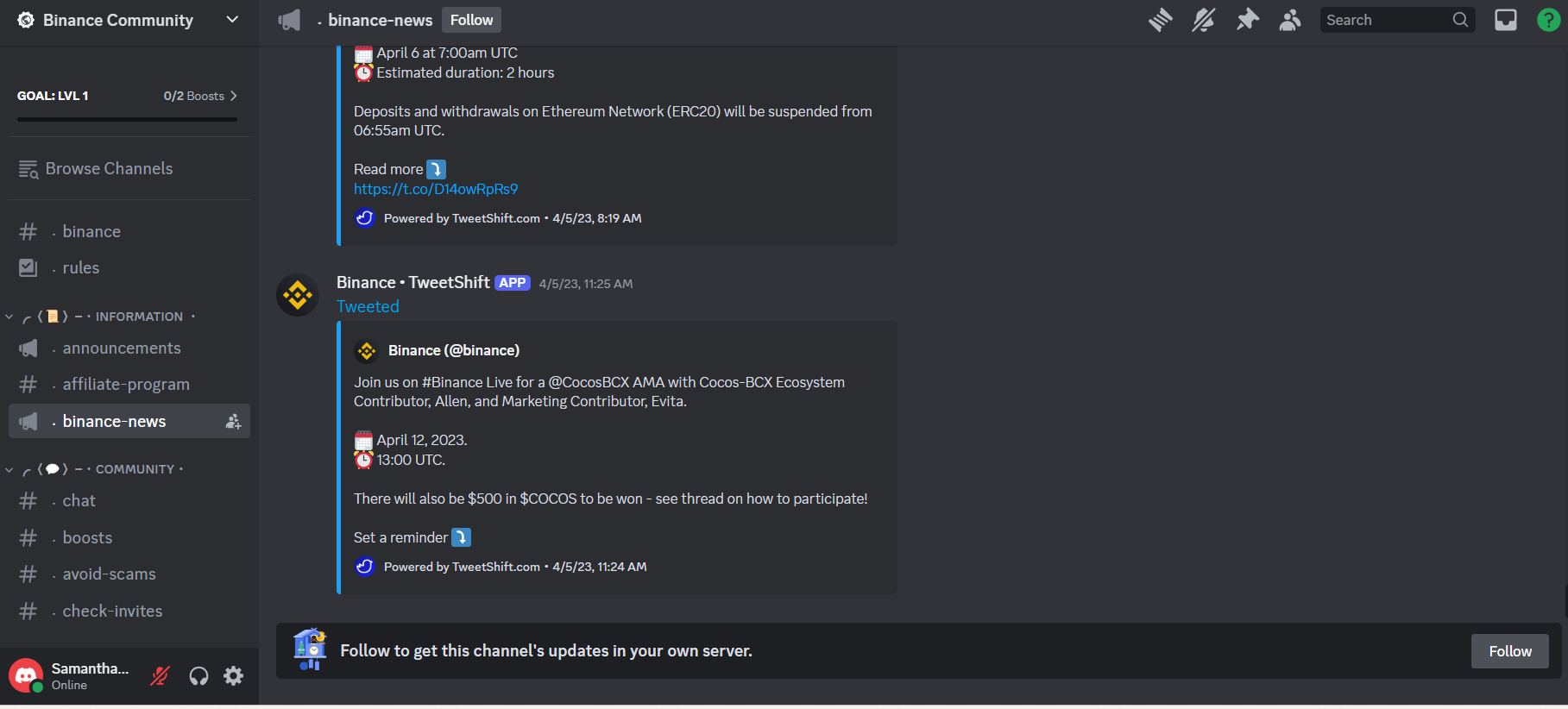

Create a Social Media Community

People love exclusive, high-value communities where they can learn and connect.

A Facebook, Discord, or LinkedIn group can build loyalty and engagement.

Do This:

- Create a members-only group for fintech users, investors, or entrepreneurs.

- Share exclusive insights, reports, and financial tips inside the group.

- Foster discussions, AMAs, and Q&As to keep the community engaged.

Example:

A digital bank is creating a private LinkedIn group called “The Future of Banking” for fintech professionals to discuss innovations.

Discord’s Community of Binance -

Smart Retargeting With Paid Social Ads

Organic social media is great, but retargeting website visitors with paid ads maximizes conversions.

Stats show that retargeting boosts conversion rates by 38%, and website visitors who see retargeted display ads are 70% more likely to make a purchase.

Do This:

- Use LinkedIn & Facebook retargeting to bring back people who visited your website.

- Create custom audience segments for different fintech user types.

- A/B test ad creatives that focus on trust, security, and simplicity.

Example:

A digital lending app running retargeted ads to users who checked loan rates but didn’t apply: “Your loan offer is waiting. Get pre-approved in 60 seconds.”

-

Partner With Influencers to Expand Your Reach

Influencers bring an authentic voice and credibility to your fintech brand and help you expand your reach to your target customers.

When partnering with the right influencers, you can humanize your fintech products, making them feel more approachable to your audience.

Do This:

- Identify influencers who are strongly connected to your target demographic, such as financial bloggers, YouTube personalities, or podcast hosts.

- Encourage influencers to showcase how your fintech solution helps solve specific financial problems, like budgeting, saving, or investing.

Example: Instead of simply running a sponsored post, collaborate with a financial influencer to create a series of “Money Management 101” videos in which they demonstrate how your app helps them track spending or invest smarter.

-

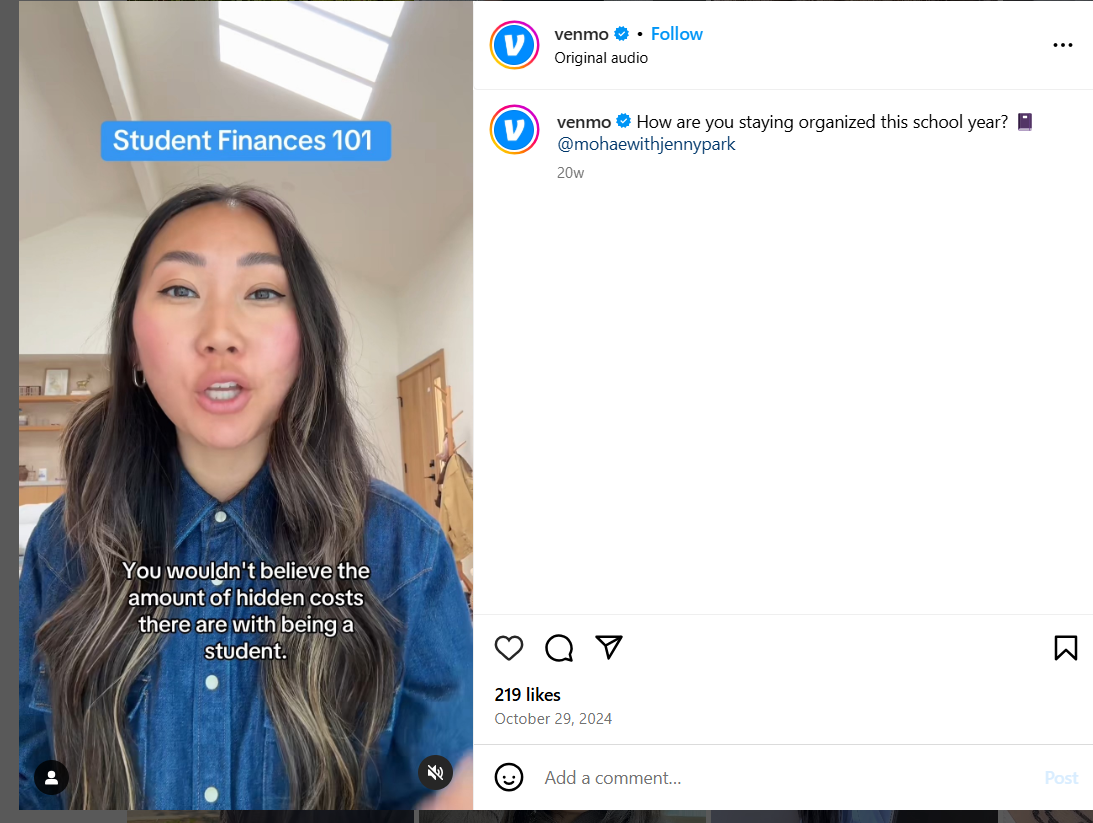

Drive Engagement With Simple, Informative Video Marketing

Video marketing is the perfect way to simplify complex fintech concepts for your audience.

With engaging visuals and concise explanations, videos can break down topics like investments or budgeting into digestible, easy-to-understand content.

Do This:

- Create short, punchy explainer videos that tackle specific pain points (like “How to Save for Retirement” or “Investing for Beginners”).

- Use animation or graphics to visually represent how your fintech product works and the benefits it brings.

- Add catchy captions and click-worthy thumbnails.

Example: Create quick “Finance 101” videos, customer success stories, or animated explainers about how your fintech product works.

An Informative Video Post by Venmo on Instagram -

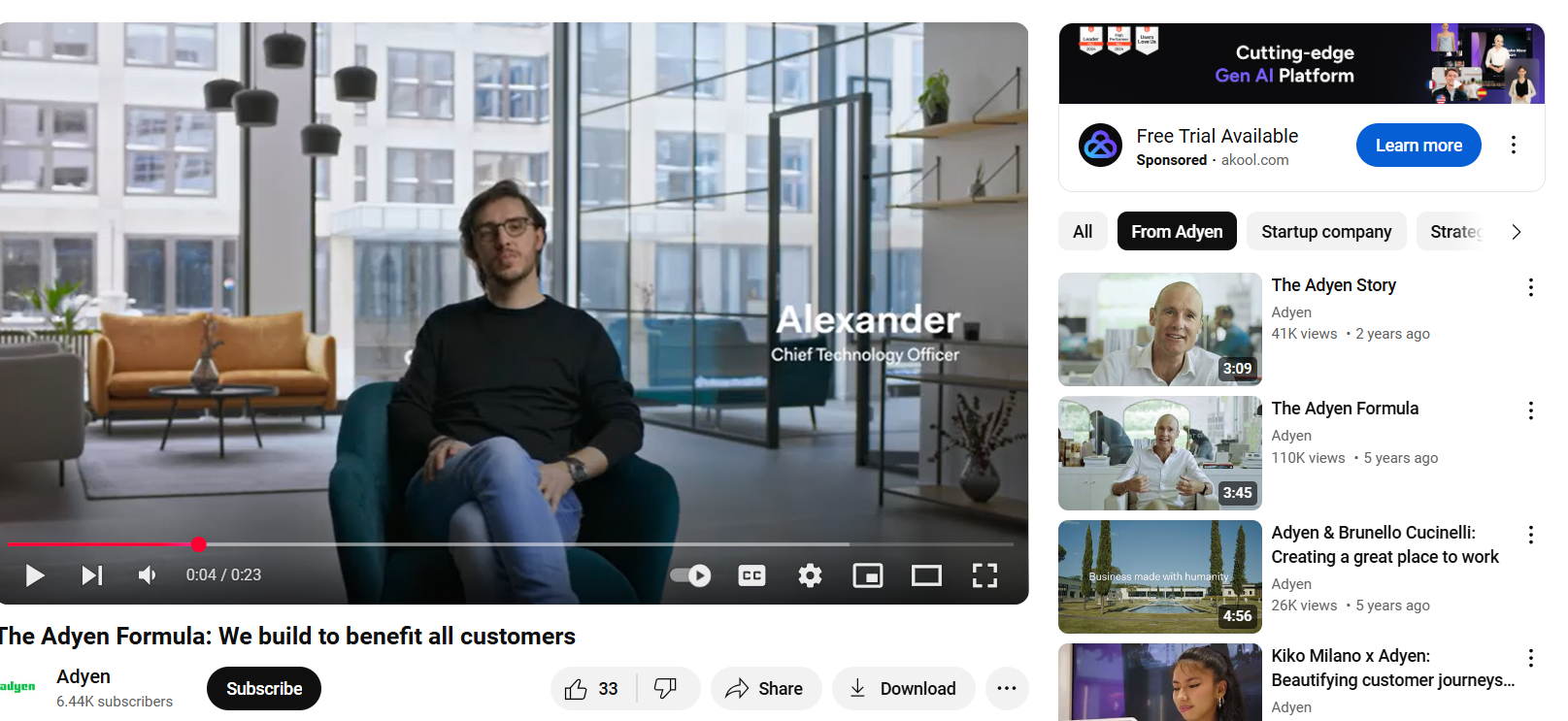

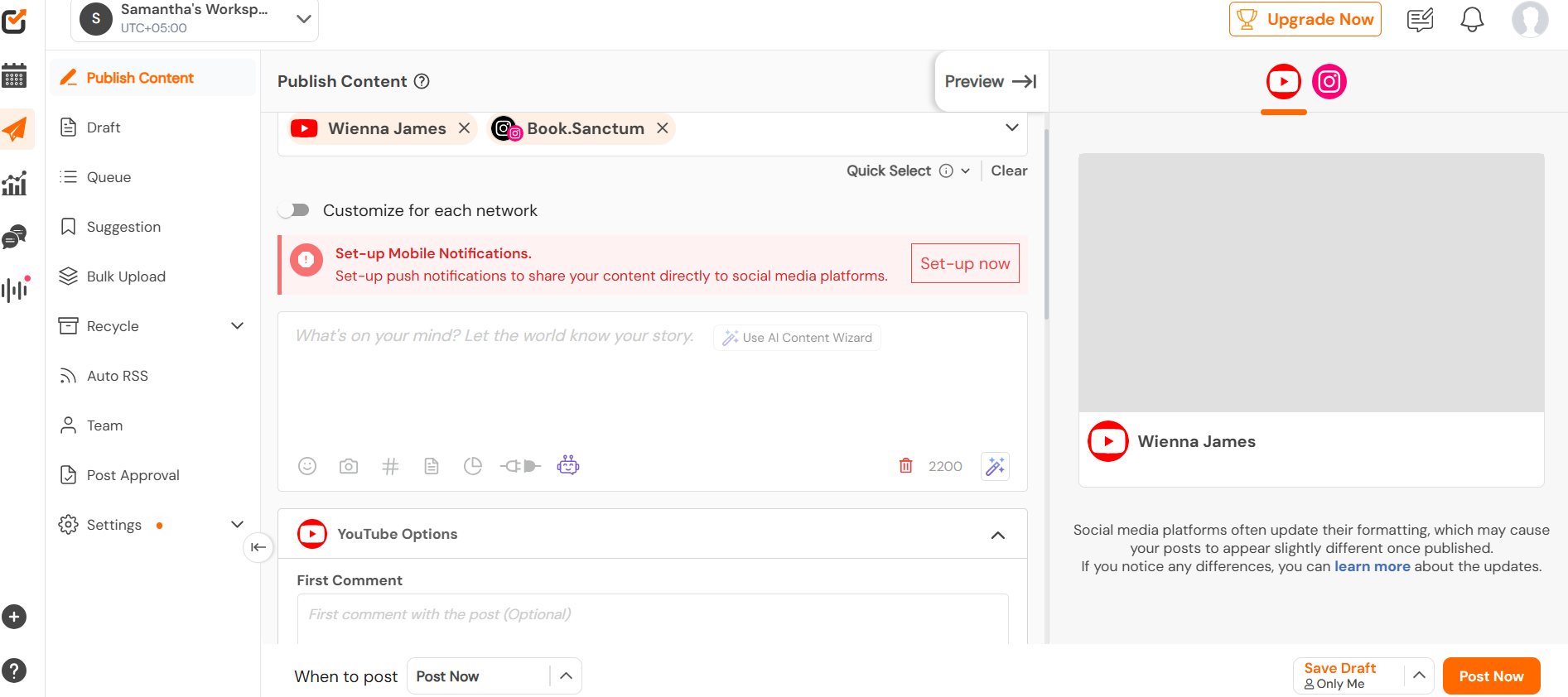

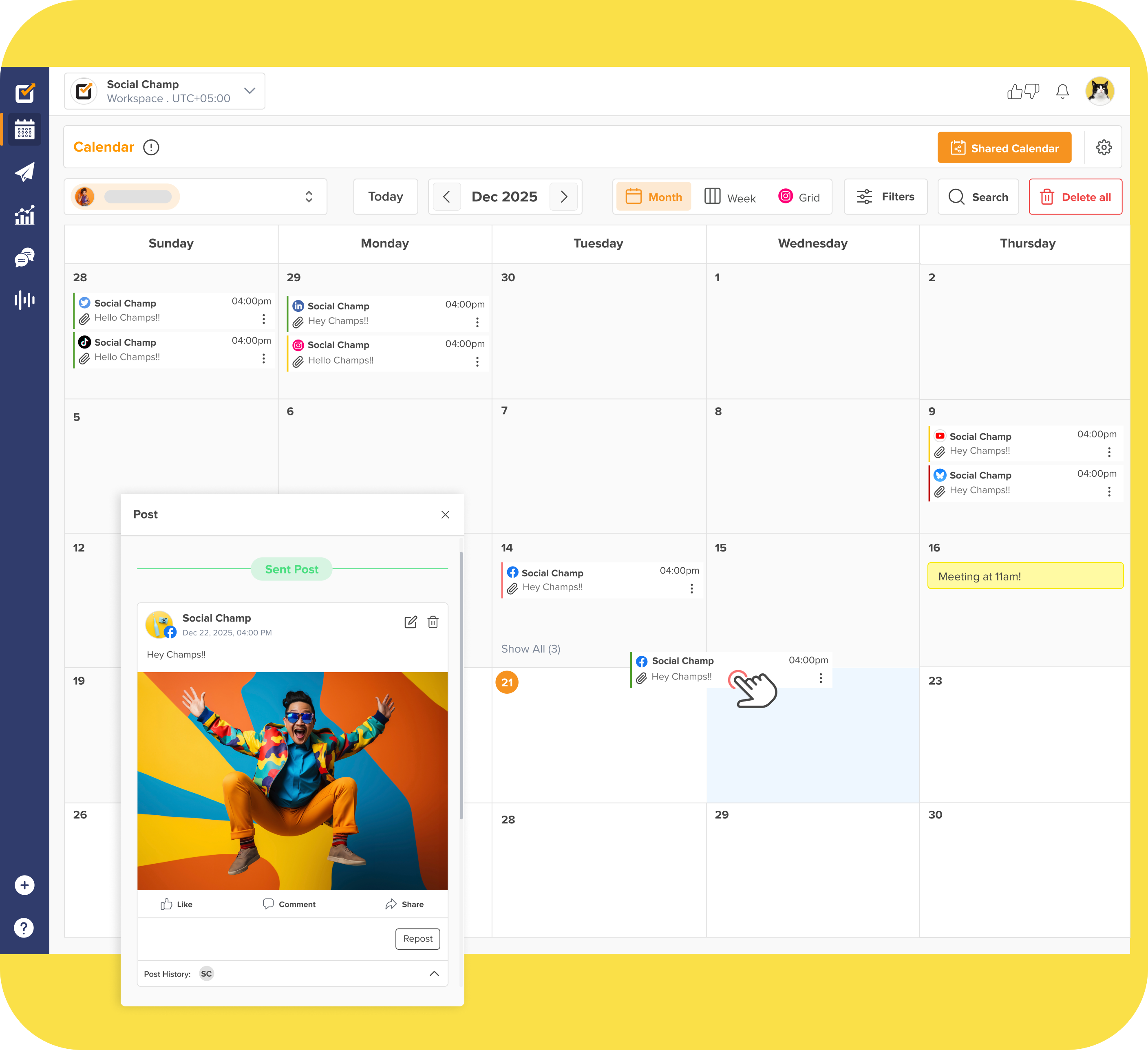

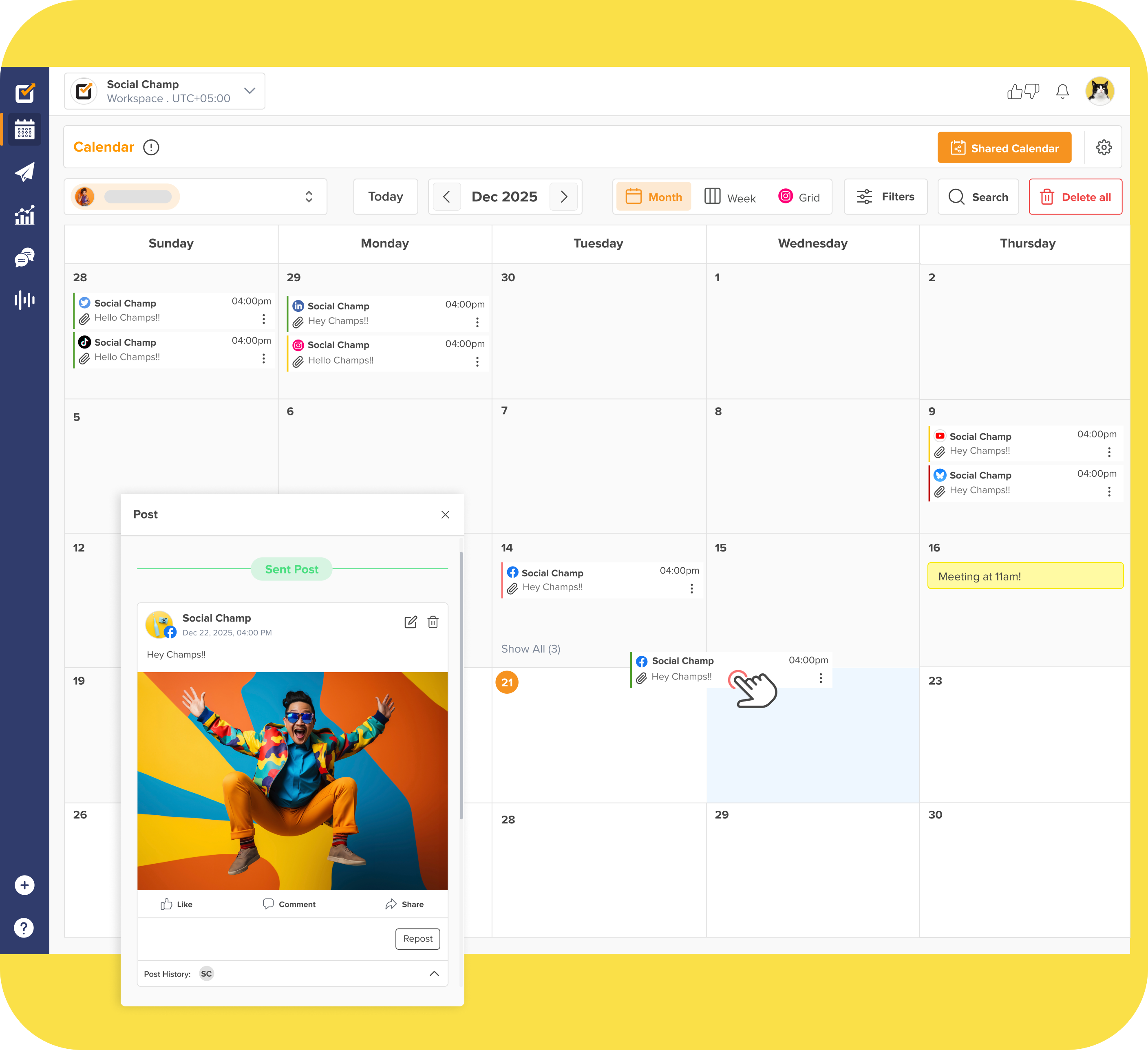

Automate & Optimize With Social Champ

Consistency is non-negotiable in fintech social media marketing, but manually managing everything is quite troublesome.

That’s where AI-powered automation tools like Social Champ make things easier.

Do This:

- Auto-schedule posts based on audience behavior.

- Analyze engagement trends to see what’s working.

- Automate multi-platform posting (LinkedIn, X, Instagram, etc.) for maximum reach.

Example: Instead of guessing when to post, use Social Champ’s AI-powered best time to post feature to hit peak engagement times automatically.

Social Champ’s Dashboard

Featured Article: How Do You Make Money on YouTube? A 2025 Guide to Success

Fintech Moves Fast. So Should Your Social Media!

Social Champ lets you schedule, analyze, and track your fintech brand’s social media without missing a beat.

Why Fintech Brands Can’t Ignore Social Media Marketing

Social media marketing offers fintech brands a unique opportunity to build trust and credibility in an otherwise complex industry.

As more consumers turn to online platforms for financial solutions, a strong social media presence is critical for staying competitive, because if you’re not on these platforms, your competitors surely are.

Without social media engagement, fintech brands risk losing potential customers who rely on these platforms for information and interaction.

But it’s not just about visibility; it’s about trust and brand perception.

Social media allows fintechs to showcase expertise, answer questions, and highlight customer success stories, all building credibility in a crowded, competitive market.

Moreover, when used effectively, social media allows fintech brands to engage with prospects, track performance, and optimize content through social media management tools like Social Champ.

How to Choose the Best Fintech Social Media Marketing Tool for Your Business

When it comes to selecting a social media marketing tool for your fintech brand, it’s essential to focus on features that can truly streamline your efforts.

Here are the key things to consider:

- Automation: You need a tool that helps you schedule posts automatically, especially if you’re managing multiple social platforms.

- Team Collaboration: Look for features that allow your team to work together smoothly, ensuring consistency and efficiency in your social media campaigns.

- Analytics: A tool that provides detailed insights into the performance of your content will help you optimize and make informed decisions.

- Security: Given the sensitive nature of fintech, choose a platform that offers secure integrations to protect your data.

Why Social Champ Is the Right Choice

Social Champ offers everything you need, from AI-powered automation to seamless team collaboration, all while ensuring your data remains secure.

It’s designed to help fintech brands scale their social media efforts efficiently, with analytics to measure success every step of the way.

Automate, Schedule, and Analyze–All With One Dashboard!

From automating team collaboration to scheduling posts and tracking analytics, Social Champ does everything from one easy-to-use dashboard!

Conclusion

Fintech social media marketing is essential for you to increase brand visibility and engagement in today’s digital world.

When done right, it can help you build trust, foster connections, and generate valuable leads for your business.

As a fintech brand, focusing on strategies like educational content, influencer collaborations, and video marketing will help you stand out in an oversaturated market.

Meanwhile, choosing the right tools is essential to streamline and enhance your marketing efforts.

With Social Champ’s powerful automation and analytics, you can easily manage your campaigns and track performance, ensuring your strategies stay on point.