The fintech battlefield is only getting fiercer, and 2025 is set to raise the stakes even higher.

It’s a war of trust, innovation, and seamless experiences—and only those with the smartest fintech marketing strategies will claim victory.

Today, users aren’t just looking for convenience anymore.

They want security, transparency, and brands that genuinely understand their financial needs.

But here’s the catch: with new competition emerging every day, your customers have more options than ever, and outdated marketing tactics won’t cut it anymore!

To dominate the digital space, your fintech brand needs marketing strategies beyond generic ads and transactional messaging.

What you need now is hyper-personalized marketing, AI-powered management tools, and loyal communities rather than just customer lists.

Let’s discuss in detail why fintech marketing is important for you and 12+ proven marketing strategies for fintech companies you can implement.

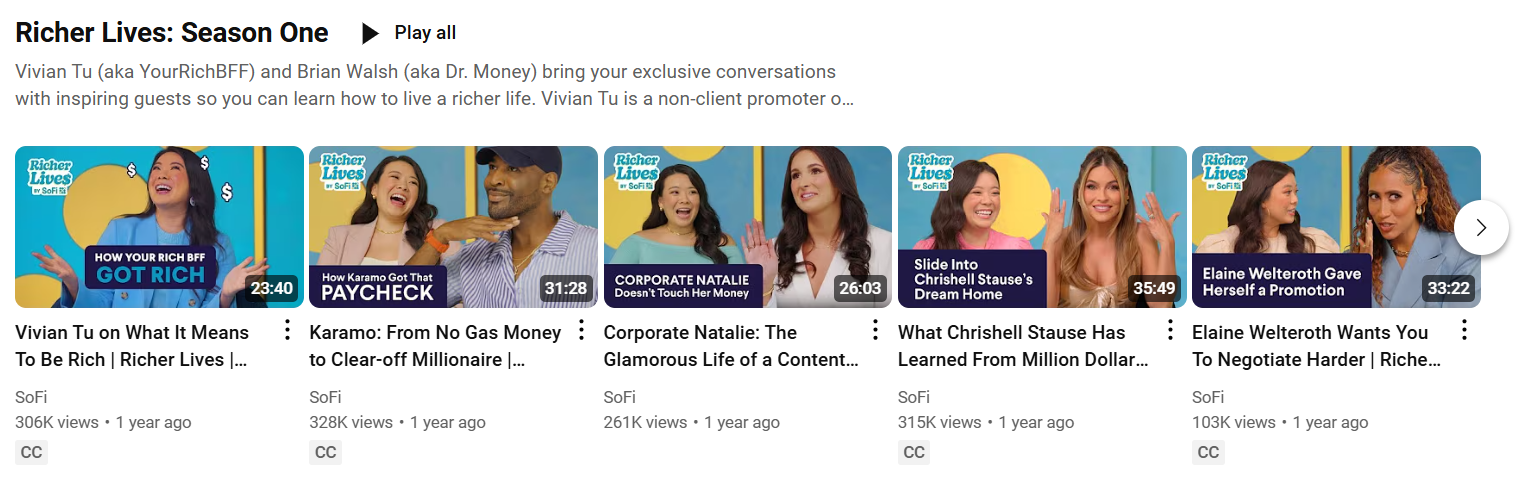

Ready to Take Your Fintech Marketing to the Next Level?

Schedule, analyze, & automate your social media campaigns with Social Champ. Start your free trial today!

Short Summary

- Fintech marketing requires brands to adopt new strategies to stay competitive.

- Content marketing remains crucial for educating users, simplifying financial concepts, and building trust.

- Social media plays a key role in fintech growth by increasing brand visibility and fostering customer relationships.

- Community-driven marketing and influencer collaborations help establish credibility and drive engagement.

- SEO optimization improves fintech discoverability and organic reach.

- Inbound phone call marketing drives higher conversion rates, generating 10–15x more revenue than web leads.

- Automation tools like Social Champ streamline scheduling, analytics, and multi-platform management.

- Data-driven marketing ensures fintech brands refine their strategies for maximum ROI.

- Future fintech trends like blockchain, embedded finance, and AI-powered chatbots will shape marketing strategies.

What Is Fintech Marketing & Why It’s More Important Than Ever?

Fintech marketing refers to the specialized strategies and tactics employed to promote financial technology products and services.

This encompasses a wide range of offerings, from online banking and digital payments to peer-to-peer lending and robo-advisors.

The primary goals of fintech marketing are to create distinct brand awareness, attract the right customers, and drive business growth in a highly competitive market.

Importance of Fintech Marketing

If you’re running a fintech business, you already know that innovation alone isn’t enough to thrive.

The real challenge is convincing customers to trust your brand in an industry where skepticism runs high and customers get easily swayed by your competition, which promises better value.

Fintech marketing is all about being trusted and keeping your customers loyal to your brand.

And that’s just the consumer part. Let’s look at the business side.

According to Fortune Business Insights, the global fintech market is valued at approximately $395.88 billion by 2025 and is projected to reach around $1126.64 billion by 2032, growing at a CAGR of 16.2%.

That means more startups, more big players, and more options for your customers to switch to.

A well-crafted marketing strategy won’t just highlight your USPs but also build trust and credibility among potential users.

Now, many financial companies are devoting thousands of dollars to marketing for fintech to stay ahead of changing consumer expectations, so why shouldn’t you?

Featured Article: A Guide to 25 AI Marketing Tools for 2025

12 + Proven Fintech Marketing Strategies to Drive Growth

Let’s take a look at some proven fintech marketing strategies that can propel business growth.

-

Build Trust Through Thought Leadership

Establishing yourself as an industry leader through educational blogs, reports, and insights can position your brand as a trusted source.

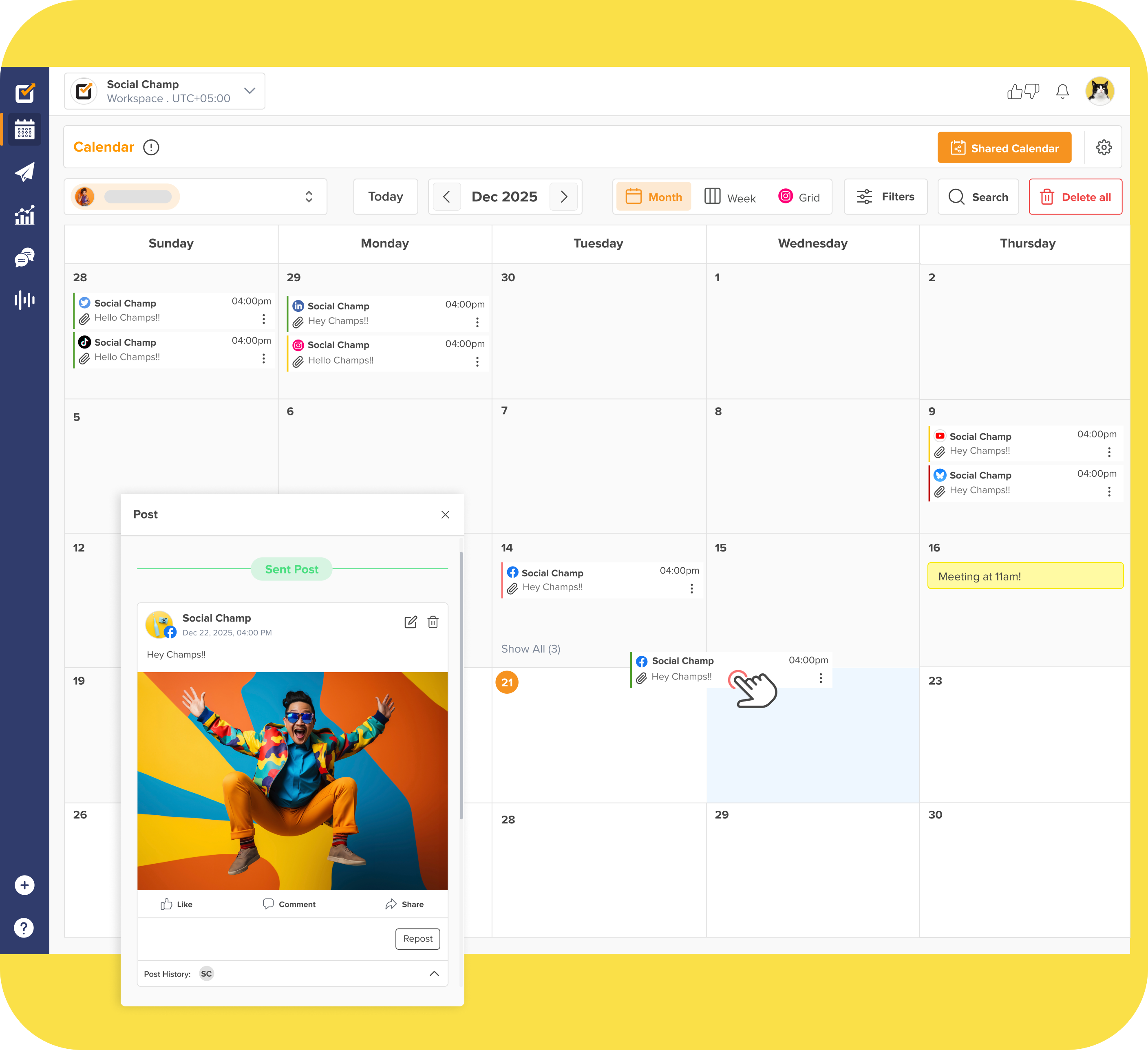

For example, Revolut publishes blogs on current trends on its website, and Stripe posts helpful guides and blogs related to deep payment insights.

Sharing your expertise in a similar or better way will help you attract informed customers and differentiate yourself in a competitive market.

Blog Page of Revolut -

Dominate Search Results With SEO

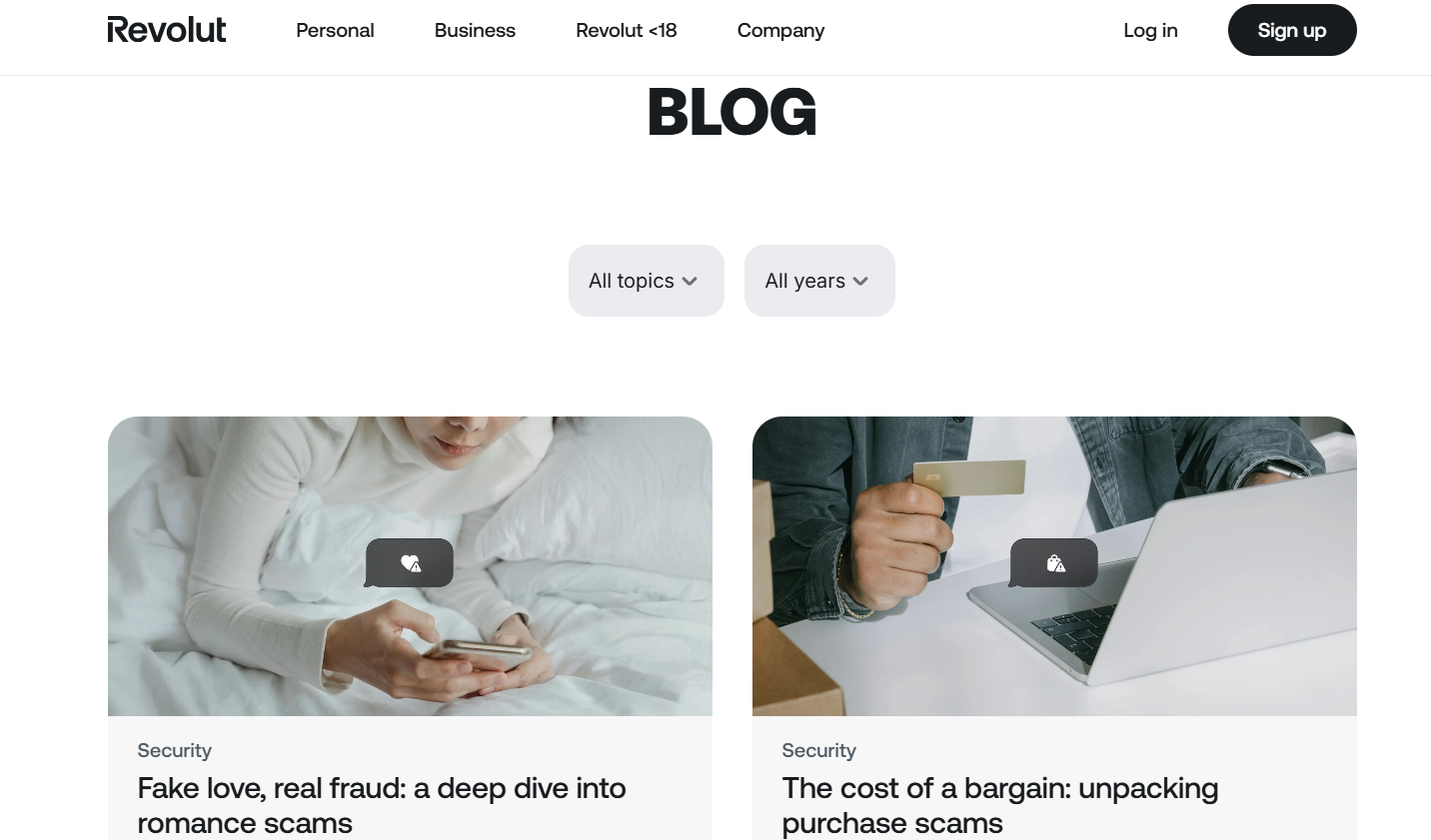

Your potential customers start with a Google search before they make a decision. You can capture this audience with keyword-optimized blogs, backlinks, and high-quality content.

For example, NerdWallet ranks for “best credit cards for travel,” while Experien dominates “how to improve credit score.” Isn’t that just some top-tier way to capture your potential customers?

By investing in SEO-driven content marketing for fintech like this, you can drive organic traffic and convert high-intent leads.

Nerdwallet Ranking in 2nd Place on Google -

Use AI-Powered Personalization

Fintech users expect personalized experiences, from investment recommendations to budget tracking.

AI-powered chatbots, predictive analytics, and hyper-personalized emails can enhance customer engagement.

By leveraging AI, you can automate personalized interactions, offer better financial insights, and improve user retention.

-

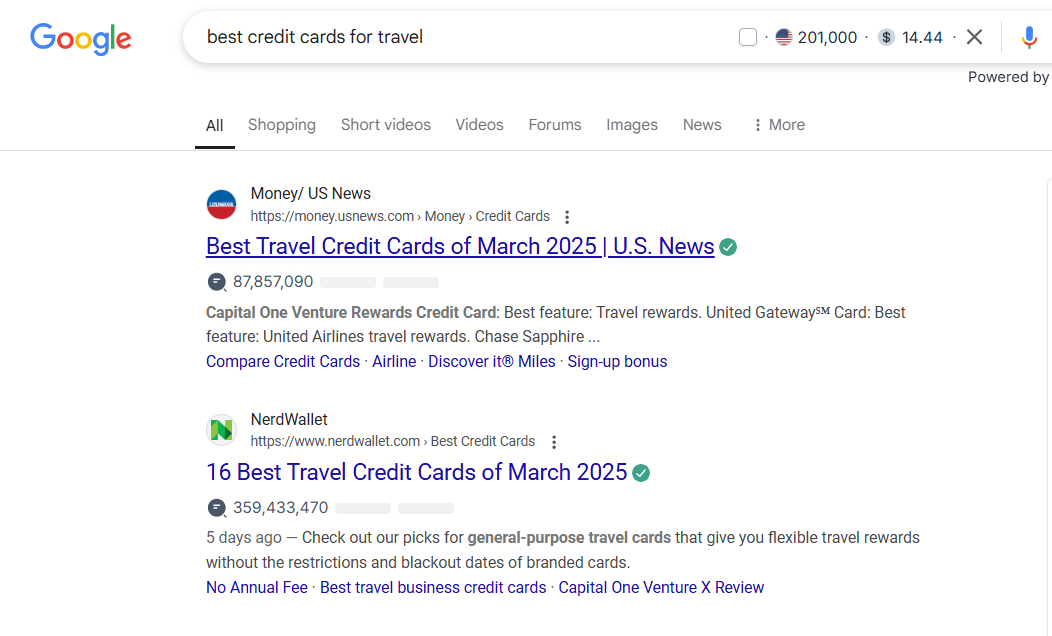

Partner With Finance Influencers

People trust recommendations from experts and peers more than traditional ads.

Partnering with celebrities, influencers, finance bloggers, TikTok creators, and YouTube influencers can expand your brand’s credibility.

Influencers who align with your brand values can help you gain authentic engagement and trust.

Take SoFi for an example. This fintech company partners with social media influencers and celebrities to enrich their content and engage users.

SoFi’s Influencer Partnerships on YouTube -

Engage in Community-Driven Growth

A strong community can drive long-term loyalty. Fintech users rely on peer discussions, online forums, and social engagement to make decisions.

Platforms like Reddit, Discord, and X can be the perfect choice for creating and engaging in online Fintech communities.

Moreover, hosting AMAs, Q&A sessions, and discussion threads can help your fintech business build brand advocates and create a direct line of communication with users.

Discord Community of Binance -

Implement a Referral Program

Word-of-mouth marketing is powerful, especially in fintech. In fact, users trust recommendations from friends and family, which makes referral incentives a great way to acquire new customers.

A well-designed referral program can drive virality, increase customer retention, and lower acquisition costs, helping you scale more efficiently.

PayPal’s Referral Program -

Leverage Video Marketing

Video content is 12x more shareable than text and images combined.

Given the high engagement rates of video, fintech brands can use it to boost awareness, improve user understanding, and increase conversion rates.

With the rise of TikTok, YouTube Shorts, and Instagram Reels, you can use video to simplify financial concepts, share customer success stories, and highlight features.

For example, Wealthsimple’s video marketing strategy is quite particular.

Instead of investment guides or how-to-vlogs, Wealthsimple takes a different and quite interesting route altogether. Produces animated explainers on investing.

Wealthsimple’s YouTube Channel -

Optimize for Mobile & App Growth

With most financial transactions happening on mobile, having an optimized app or website is crucial for user retention.

A seamless mobile experience includes:

- Intuitive UI/UX

- Fast load times

- Easy navigation

- Personalized features

You should also leverage push notifications, in-app messaging, and gamification to enhance engagement.

Optimizing for mobile growth ensures higher user satisfaction, increased downloads, and better long-term retention.

-

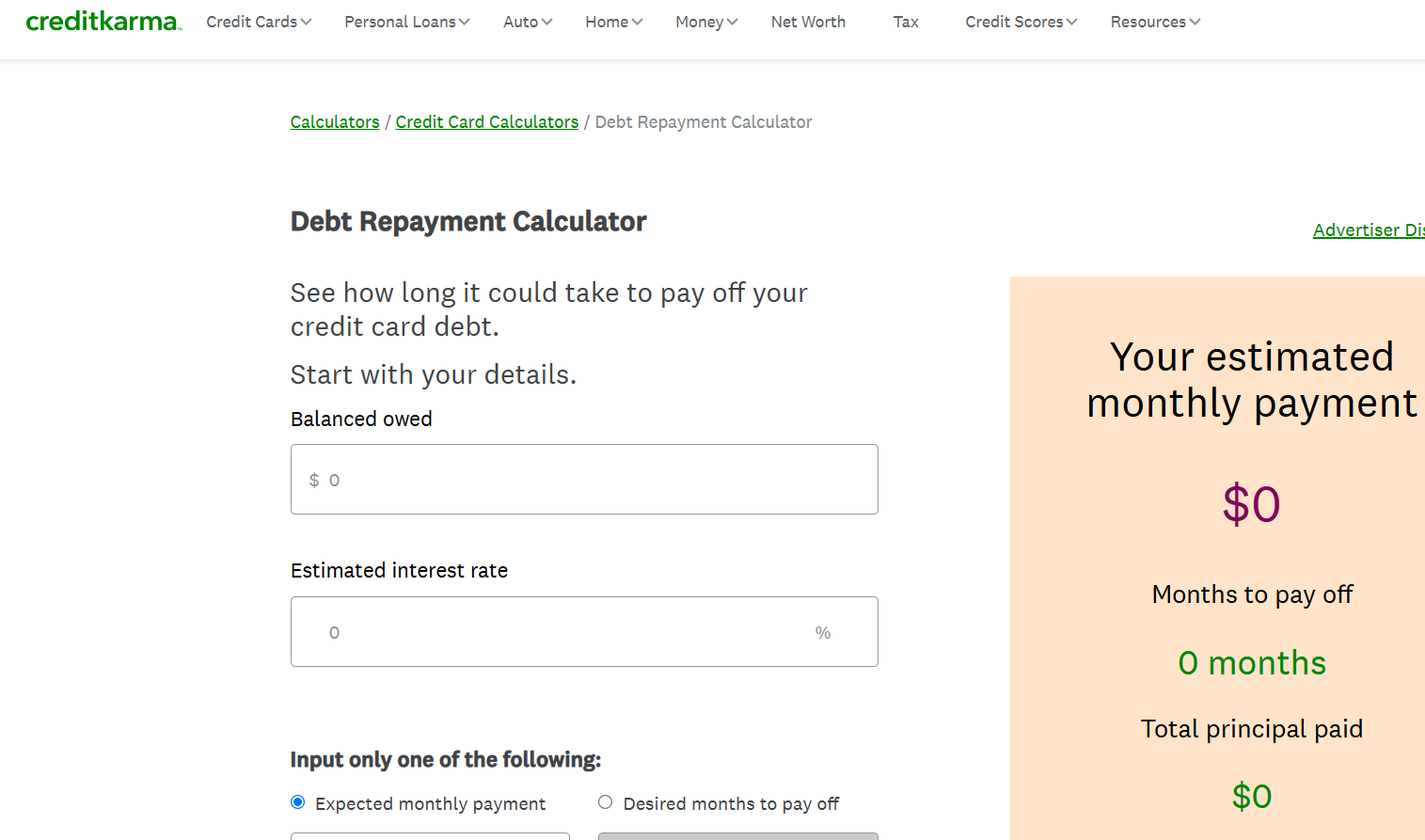

Offer Interactive Financial Tools

Customers engage more with fintech brands that offer value-driven, interactive experiences.

Tools like loan calculators, investment simulators, and budget planners provide instant solutions, increasing user engagement.

These tools also serve as lead-generation assets by capturing user data for personalized follow-ups.

Interactive tools enhance customer experience, improve decision-making, and position fintech brands as helpful resources.

Creditkarma’s Debt Repayment Calculator -

Scale With Paid Ads & Retargeting

While organic marketing strategies for fintech companies build long-term growth, paid advertising provides immediate visibility and targeted reach.

Using platforms like Google Ads, LinkedIn, Facebook, and Twitter (X), fintech brands can target users based on demographics, interests, and financial behavior.

Retargeting further enhances ad performance by re-engaging past visitors and nudging them toward conversion.

A data-driven paid ad strategy can generate leads, improve brand recall, and maximize ROI.

-

Leverage Behavioral Email Marketing

Email remains one of the most effective channels for customer engagement and lead nurturing.

Behavioral email marketing focuses on sending personalized, automated emails based on user actions—such as sign-ups, abandoned transactions, or past purchases.

Emails, newsletters, and AI-driven content recommendations help fintech brands increase open rates and conversions.

A well-planned email strategy keeps users engaged, nurtures leads, and improves retention rates.

-

Use Social Proof & Customer Testimonials

Financial decisions require trust, and social proof plays a crucial role in reassuring potential customers.

Displaying real customer reviews, success stories, case studies, and industry endorsements builds credibility.

Fintech brands should showcase user testimonials, ratings, and verified customer feedback across marketing channels to increase confidence and drive conversions.

Social proof reduces skepticism, enhances brand reputation, and improves customer acquisition.

Case Studies by Fintech Futures -

Innovate With Gamification & Rewards

Gamification makes finance engaging and habit-forming by incorporating challenges, rewards, and milestone-based incentives.

Features like savings streaks, achievement badges, and personalized financial goals encourage users to interact with the platform more frequently.

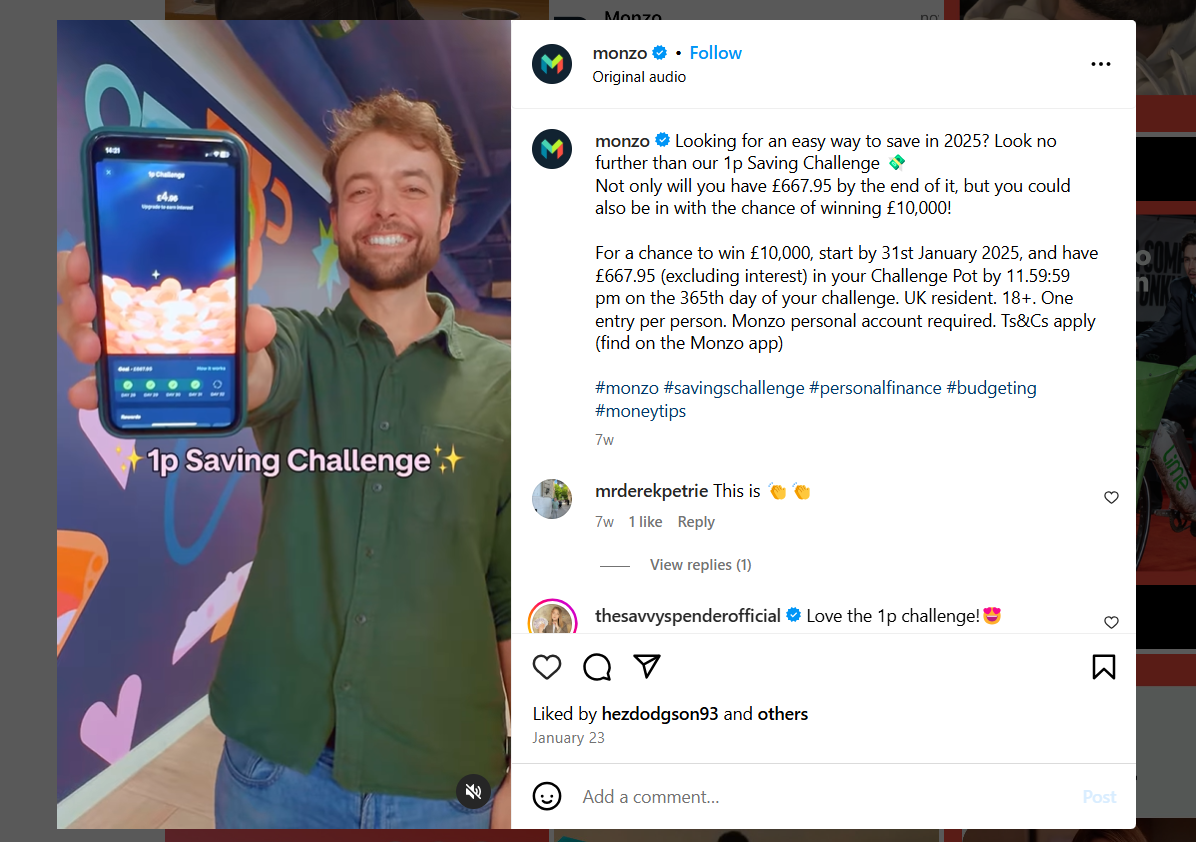

For example, Monzo started a “1Psaving challenge” that garnered a lot of buzz and attracted more users to their brand.

Monzo’s 1P Saving Challenge on Instagram -

Maximize Conversions With Inbound Phone Call Marketing

While digital ads and social media campaigns bring in leads, nothing beats the power of a direct phone conversation.

Studies show that 84% of marketers report higher conversion rates and larger order values (AOV) from phone calls compared to other engagement methods.

Inbound phone marketing allows fintech brands to offer personalized consultations, answer complex questions, and address customer concerns directly.

Optimizing call tracking, response times, and trained sales teams can significantly increase trust, improve customer acquisition, and maximize revenue potential.

Featured Article: How Content Localization Can Boost Your Social Media Strategy in 2025

How Fintech Brands Use Social Media to Build Trust & Visibility

Trust is the foundation of any successful fintech brand. Customers want to know that their money, data, and transactions are secure.

Social media provides a unique opportunity to bridge the trust gap by fostering transparency, engagement, and credibility.

But in an industry where misinformation and skepticism are prevalent, platforms like LinkedIn, Twitter (X), and Facebook offer fintech companies the chance to engage directly with users, address concerns, and showcase transparency.

Beyond just marketing, social media serves as a real-time communication tool that fosters long-term customer relationships.

-

Building a Community That Drives Engagement & Trust

Customers want more than just financial services—they seek a sense of belonging and reliability.

Social media allows fintech brands to build engaged communities where users can discuss industry trends, ask questions, and share experiences.

Platforms like Facebook Groups, LinkedIn communities, and Twitter Spaces provide fintech companies with direct interaction opportunities.

Hosting AMAs (Ask Me Anything), live Q&A sessions and interactive polls make customers feel valued, strengthening their confidence in your brand.

-

Leveraging Social Listening to Understand & Serve Customers

Fintech customers are highly vocal about their experiences, both positive and negative.

Social listening helps fintech brands track conversations, identify pain points, and respond proactively.

Using Social Champ’s social listening features, you can monitor brand mentions, industry discussions, and customer feedback across platforms.

This allows you to adjust your messaging, improve customer experience, and address concerns in real-time, reinforcing trust and credibility.

Catch Every Financial Pulse in Real-Time

With Social Champ’s Social Listening, you catch every whisper—customer concerns, trending terms, investor buzz—as it happens. Start your free trial now and start listening!

-

Enhancing Transparency & Crisis Management

Trust in fintech is fragile, and misinformation spreads quickly. Whether it’s a new feature rollout, system downtime, or security update, keeping your audience informed is essential.

Social media provides a real-time channel for updates, ensuring that customers hear important news directly from your brand rather than unreliable sources.

Timely and transparent communication helps maintain customer confidence and minimizes reputational risks.

Should You Hire a Fintech Marketing Agency or Automate?

When it comes to fintech marketing, you have two primary choices: outsource to a marketing agency or leverage automation tools.

Both options have their advantages, but the right choice depends on your budget, goals, and the level of control you want over your campaigns.

Agencies bring expertise but come with high costs, while automation tools provide efficiency and cost savings without sacrificing performance.

The Cost of Outsourcing vs. Automating

Hiring a fintech marketing agency can be a significant investment.

Agencies typically charge between $1500 to $10,000+ per month, depending on the scope of work and expertise required.

While they handle everything from strategy to execution, the high costs might not be feasible for startups or growing businesses.

On the other hand, automation tools offer a more budget-friendly alternative, allowing you to manage social media, schedule posts, track analytics, and engage with customers—all at a fraction of the cost.

For example, Social Champ offers the best pricing options depending on your business size with initial price starting just from $4/month.

If you’re looking for an affordable yet effective way to streamline fintech marketing, automation tools like Social Champ are the answer.

With AI-powered content scheduling, social listening, and in-depth analytics, you can maintain a consistent online presence, monitor brand mentions, and analyze campaign performance without the need for an expensive agency.

No More Switching Between Platforms!

Manage LinkedIn, X, Instagram, and more from one place with Social Champ and keep your fintech brand active without the hassle.

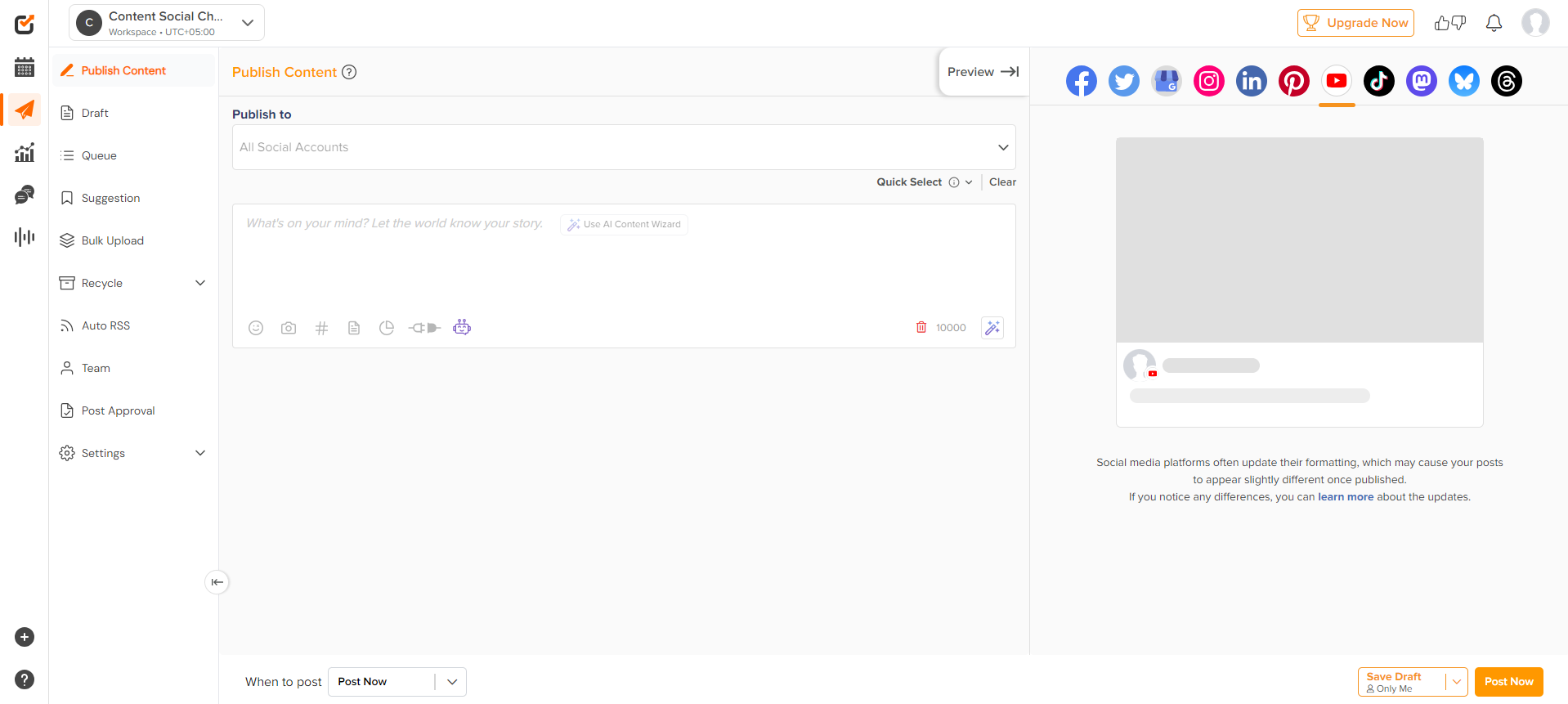

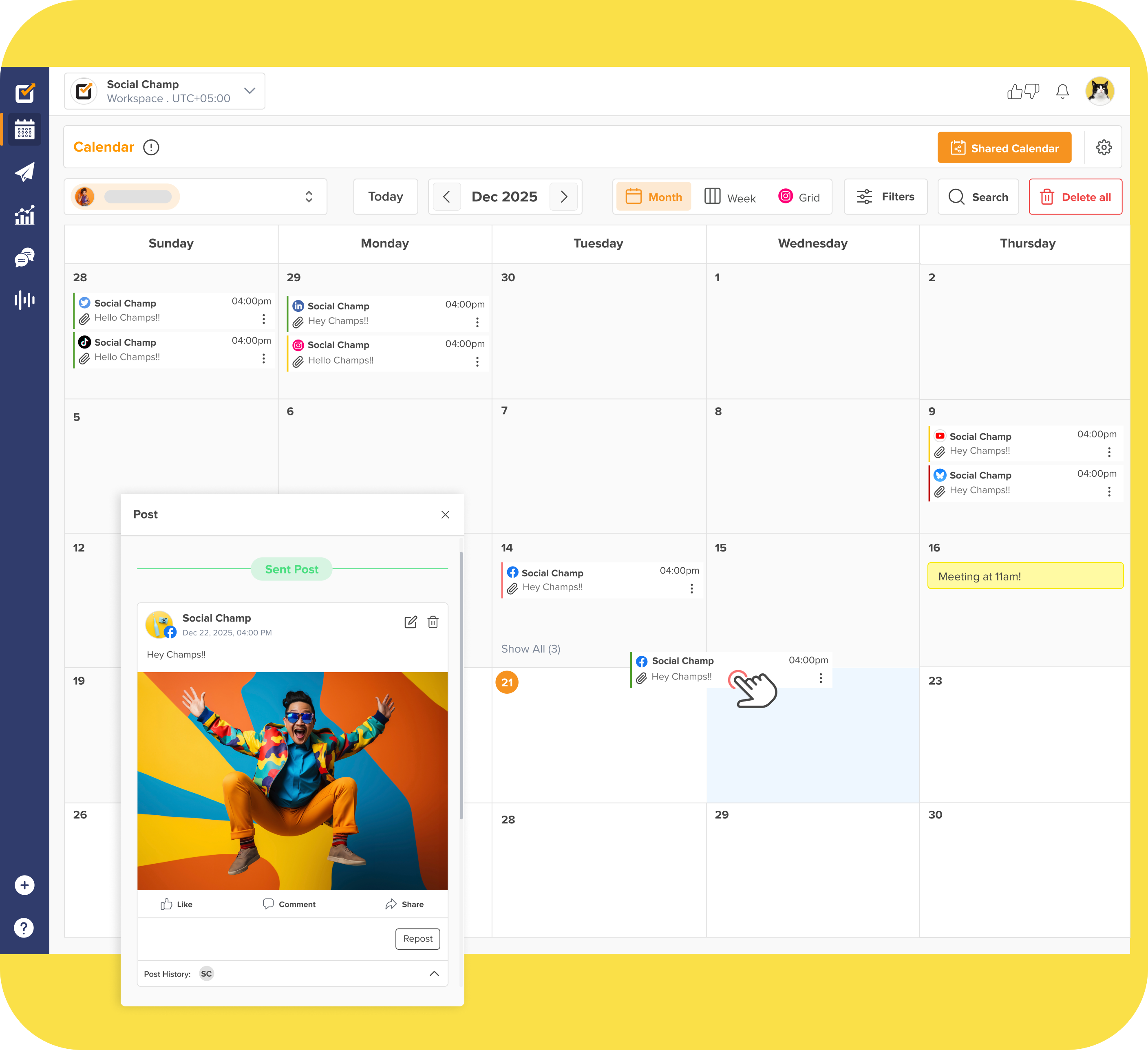

Social Champ: The #1 Fintech Social Media Automation Tool

Managing fintech marketing shouldn’t be overwhelming.

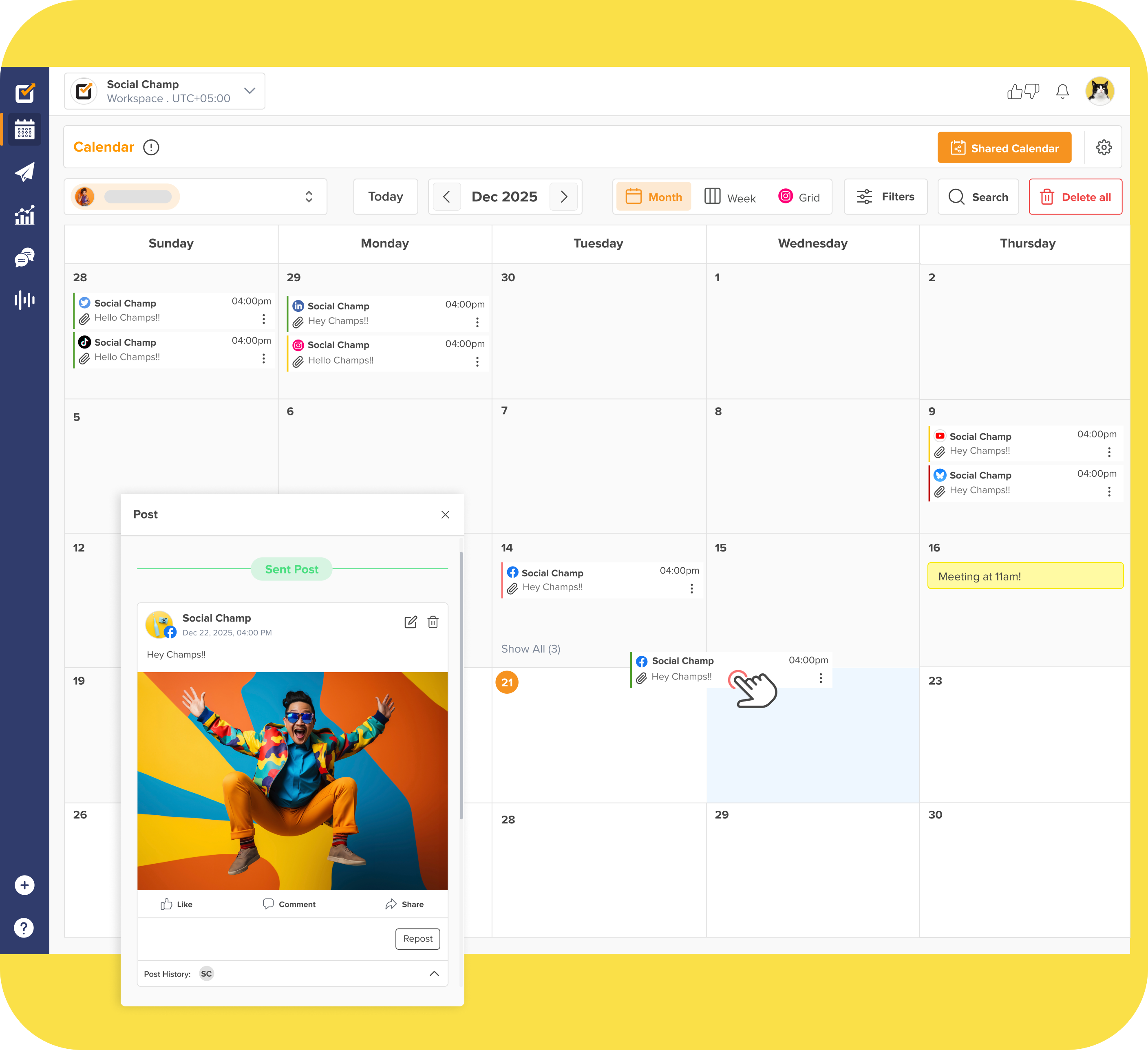

With Social Champ, you get an all-in-one automation tool designed to help fintech brands streamline their social media efforts, save time, and boost engagement—all from a single dashboard.

- All Your Social Accounts in One Dashboard

Instead of juggling multiple platforms, you can manage everything from a single dashboard. This means less time switching tabs and more time focusing on scaling your business. - Bulk Upload to Plan Ahead

Social Champ’s bulk upload feature allows you to schedule several posts at once, saving you the hassle of everyday logins and constant posting.

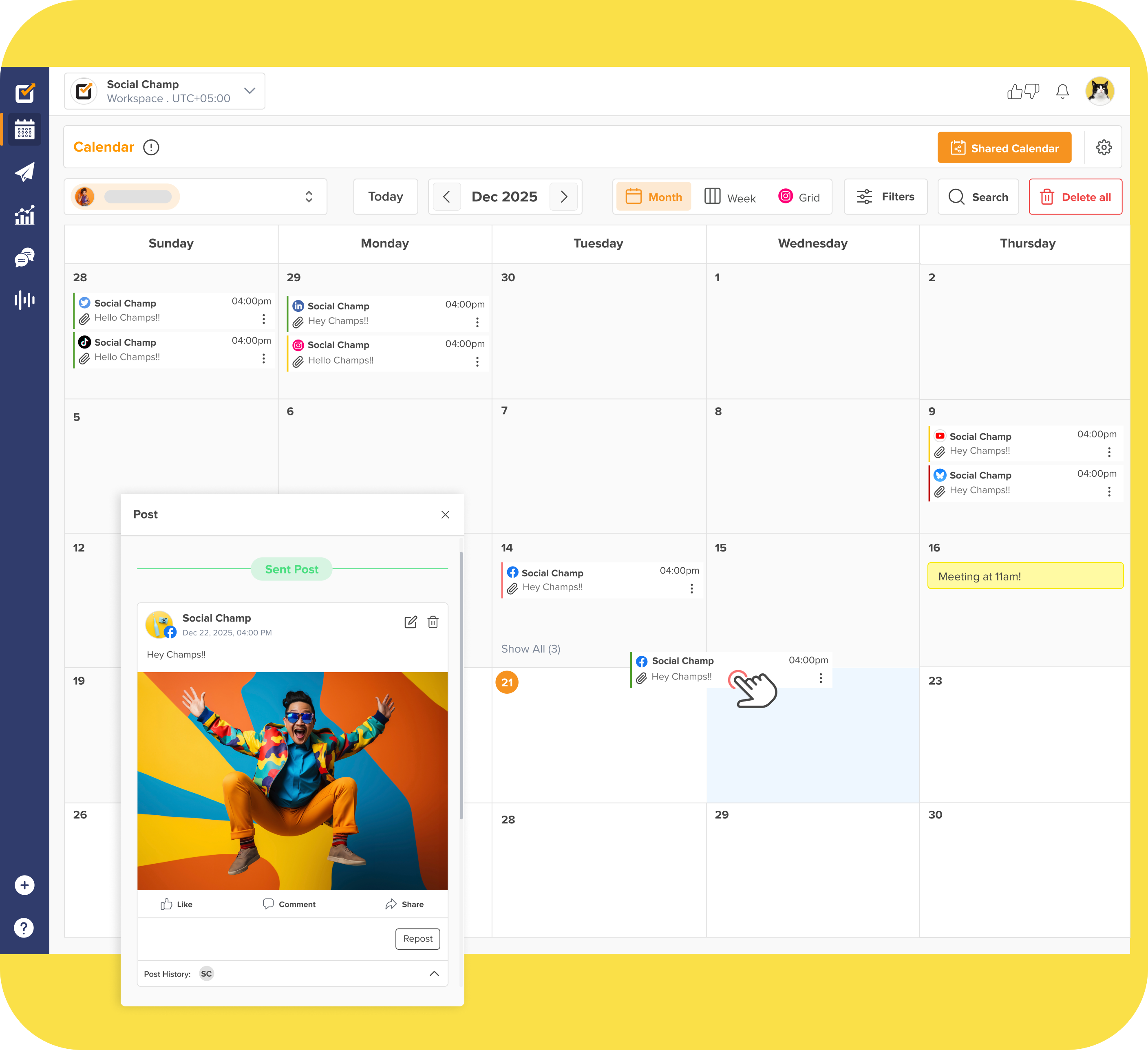

- Automated Posting & Scheduling Across Multiple Platforms

With scheduling for LinkedIn, Twitter (X), and Instagram, you can reach the right audience at the right time, staying relevant in fintech conversations.

- Champ’s AI Suite to Enhance Your Content

Struggling with captions or fresh ideas? Social Champ’s AI tools generate engaging captions, visual content, and trending hashtags, making your social media marketing effortless.

- Analytics to Guide Your Strategy

Data-driven decisions matter in fintech. Social Champ provides detailed analytics so you can track engagement, measure success, and tweak your approach for better results.

If you’re looking for a cost-effective and efficient way to manage your fintech brand’s social media, Social Champ offers the automation and AI-powered tools you need to stay ahead.

Fintech Moves in Seconds. So Should You.

Social Champ lets you schedule hundreds of posts in seconds, keeping your fintech content calendar running smoothly without the manual hassle.

Future of Fintech Marketing: Trends to Watch in 2025

Fintech marketing is evolving fast, and staying ahead of the curve is essential to remain competitive.

As we move into 2025, new trends are shaping how fintech brands connect with customers, build trust, and drive growth.

Here’s what’s coming next:

-

AI-Driven Personalization

Artificial Intelligence (AI) is taking fintech marketing to the next level by making customer interactions highly personalized.

AI analyzes user behavior to recommend financial products, send tailored messages, and automate responses—creating a smoother and more engaging customer journey.

Thanks to continuous advancement in AI technology, we can only predict how it will revolutionize the fintech industry even more.

-

Blockchain for Transparency & Security

Blockchain technology is becoming a major asset in fintech marketing. Its ability to enhance security, prevent fraud, and increase transaction transparency makes it a game-changer.

As consumers demand more trust in financial services, blockchain’s role will only grow.

-

Cybersecurity as a Top Priority

With fintech companies handling sensitive data, cybersecurity isn’t optional—it’s a necessity.

Brands are doubling down on advanced security measures like biometric authentication and AI-powered fraud detection to protect customers and maintain credibility.

-

The Rise of Open Banking

Open Banking is transforming fintech by allowing third-party apps to securely access financial data (with user consent).

This means more personalized financial tools and greater competition, leading to better services and lower costs for consumers.

-

Behavioral Biometrics for Smarter Security

Traditional passwords and PINs are losing relevance.

Instead, fintech companies are adopting behavioral biometrics—analyzing typing speed, touchscreen pressure, and navigation patterns—to create seamless yet secure user authentication.

-

Virtual Cards Are Becoming the Norm

Physical credit cards are slowly being replaced by virtual cards, which offer better security and control.

More fintech companies are pushing for digital-first solutions to reduce fraud and streamline transactions.

-

Decentralized Finance (DeFi) Is Expanding

DeFi is reshaping how people borrow, lend, and invest—without traditional banks.

As more users explore DeFi platforms, fintech marketers must educate their audience and ensure transparency to build trust in this rapidly evolving space.

-

Stricter Regulations Are Coming

Governments are tightening fintech regulations to protect consumers and prevent financial crimes.

Companies must stay compliant while finding creative ways to innovate and market their services effectively.

-

Contactless Payments & Digital Wallets Are Taking Over

Cash is becoming a thing of the past. Consumers now prefer contactless payments and digital wallets for their convenience and security.

Fintech companies that embrace these technologies will stay ahead of the competition.

-

Data-Driven Marketing for Better Customer Insights

Financial institutions are increasingly utilizing customer data to develop targeted and potentially profitable services.

This approach requires balancing innovation with privacy concerns to maintain customer trust.

Conclusion

Fintech marketing in 2025 is all about innovation, personalization, and trust.

Through AI, social media, and automation, you can stay ahead of the competition and connect with your audience more effectively.

As trends evolve, adapting to new marketing strategies for fintech companies will be key to long-term success.

Now is the time to refine your marketing approach and position your fintech brand for sustainable growth.