Insurance marketing is no longer just about selling policies.

It’s about building trust, creating relationships, and offering real value to your customers.

Today, insurance companies need fresh and creative strategies to stand out.

Additionally, 87% of insurance companies believe that digital transformation is critical to their future success, with social media and automation playing a key role.

And with tools like Social Champ, insurance providers can now connect with their audience more effectively than ever before.

If you’re looking for ways to manage your insurance marketing, you’re in the right place.

This guide will walk you through the latest trends, challenges, and best practices to help you succeed.

Let’s get started!

Struggling With Insurance Marketing?

Save time and boost engagement with Social Champ. Plan, publish, and analyze campaigns to grow your insurance business effortlessly.

Short Summary

- Insurance marketing is now about building trust, and relationships, and providing value rather than just selling policies.

- Effective marketing strategies generate leads and boost revenue by attracting and nurturing potential customers.

- Challenges include regulatory compliance, high competition, and evolving consumer expectations.

- Content marketing, including blogs, videos, and infographics, educates and builds trust with potential clients.

- Social media is a powerful tool for sharing tips, and success stories and engaging directly with customers.

- Automation tools streamline marketing efforts, allowing efficient campaign planning and management.

- Social Champ provides an all-in-one solution for scheduling, publishing, and analyzing insurance marketing campaigns.

Why Insurance Marketing Matters

Effective insurance marketing is the backbone of any successful insurance business.

It’s not just about selling policies; it’s about creating a strong connection with your audience.

Let’s break down why it matters and how it can transform your business.

Building Trust With Your Audience

Trust is the foundation of any insurance business.

Customers need to feel confident that you’ll be there when they need you the most.

Effective insurance marketing helps you build this trust by showcasing your expertise and reliability.

For example, sharing client testimonials or case studies can show real-life examples of how you’ve helped others.

When people trust your brand, they’re more likely to choose you over competitors.

Generating Leads and Growing Revenue

One of the main goals of insurance marketing is to generate leads.

This means finding potential customers who are interested in your policies.

With a strong marketing strategy, you can attract these leads and guide them through the buying process.

For instance, offering a free consultation or a downloadable guide can encourage people to share their contact details.

Once you have their information, you can nurture these leads and turn them into paying clients.

This not only boosts your revenue but also helps your business grow.

Standing Out in a Competitive Market

Today’s customers have endless options when it comes to insurance providers.

They can compare policies, prices, and reviews with just a few clicks.

This makes it crucial for your brand to stand out.

Marketing for insurance ensures that your brand remains visible and relevant.

For example, using social media to share helpful tips or success stories can keep your audience engaged.

When you stand out, you increase your chances of being chosen over competitors.

Understanding Your Audience’s Needs

To create effective marketing campaigns, you need to understand your audience.

What are their concerns?

What solutions are they looking for?

For instance, a young family might be looking for affordable life insurance, while a business owner may need liability coverage.

By customizing your message to these specific needs, you can create campaigns that truly resonate.

This not only attracts potential clients but also builds long-term loyalty.

Creating Long-Term Loyalty

Insurance marketing isn’t just about attracting new customers; it’s also about keeping them.

When customers feel understood and valued, they’re more likely to stay with your brand.

They’ll also recommend you to others, which is one of the most powerful forms of marketing.

For example, offering personalized follow-ups or loyalty rewards can strengthen your relationship with existing clients.

By focusing on trust, relevance, and value, you can create a marketing strategy that drives real results.

Featured Article: Franchise Marketing 101: Strategies, Challenges, and the Best Tools to Succeed

Understanding the Insurance Marketing Landscape

The world of insurance marketing is always changing.

New technologies and shifts in how people behave are shaping the way insurance companies reach their customers.

To succeed, you must understand these changes and adapt your strategies accordingly.

Let’s explore the key trends, challenges, and opportunities in today’s insurance marketing situation.

The Rise of Digital Marketing for Insurance

One of the biggest trends in insurance marketing is the move toward digital platforms.

More and more people are using the Internet to research and buy insurance.

This means companies need to focus on digital marketing for insurance to stay competitive.

Here are some popular digital strategies:

- Social Media Ads: Platforms like Facebook, Instagram, and LinkedIn allow you to target specific audiences.

- Email Campaigns: Sending personalized emails can help you stay in touch with potential and existing clients.

- Content Marketing: Blogs, videos, and infographics can educate your audience and build trust.

These tools make it easier to reach a wider audience and engage with them effectively.

Challenges in the Insurance Marketing Landscape

While digital marketing offers many opportunities, it also comes with challenges.

Here are some common hurdles insurance companies face:

- Regulatory Compliance: Insurance is a highly regulated industry, and marketing efforts must follow strict rules.

- Fierce Competition: With so many providers, standing out can be tough.

- Changing Consumer Behaviour: Customers today expect personalized and instant service.

To overcome these challenges, insurers need to stay updated on the latest tools and strategies.

Staying Ahead of the Curve

To succeed in insurance marketing, you need to stay ahead of the curve.

This means keeping up with the latest trends and technologies.

For example, using AI-powered tools can help you analyze customer data and predict their needs.

Automation can also save time by handling repetitive tasks like scheduling social media posts or sending follow-up emails.

By embracing these innovations, you can plan your marketing efforts and focus on what really matters—building relationships with your customers.

Crafting Effective Marketing Strategies

Understanding the insurance marketing landscape is key to creating effective strategies.

Here’s how you can do it:

- Know Your Audience: Research your target customers to understand their needs and preferences.

- Use Data Analytics: Analyze data to identify trends and improve your campaigns.

- Focus on Personalization: Customize your messages to address specific customer concerns.

By staying informed and adapting to changes, you can position your brand as a trusted leader in the industry.

Want to Simplify Insurance Marketing?

Stay ahead with automated scheduling, in-depth analytics, and seamless social media management—all in one platform.

Proven Strategies to Succeed in Insurance Marketing

To succeed in the competitive world of insurance marketing, you need proven strategies that work.

Here are some effective approaches to attract, engage, and convert potential clients.

-

Embrace Digital Marketing for Insurance

Digital tools have completely changed the way insurance companies market their services.

They offer endless opportunities to connect with your audience and grow your business.

Here’s how you can make the most of digital marketing for insurance:

- SEO-Optimized Blogs: Write articles that answer common questions about insurance. For example, “What is life insurance?” or “How to choose the right health insurance plan.”This helps your website rank higher on search engines, making it easier for people to find you.

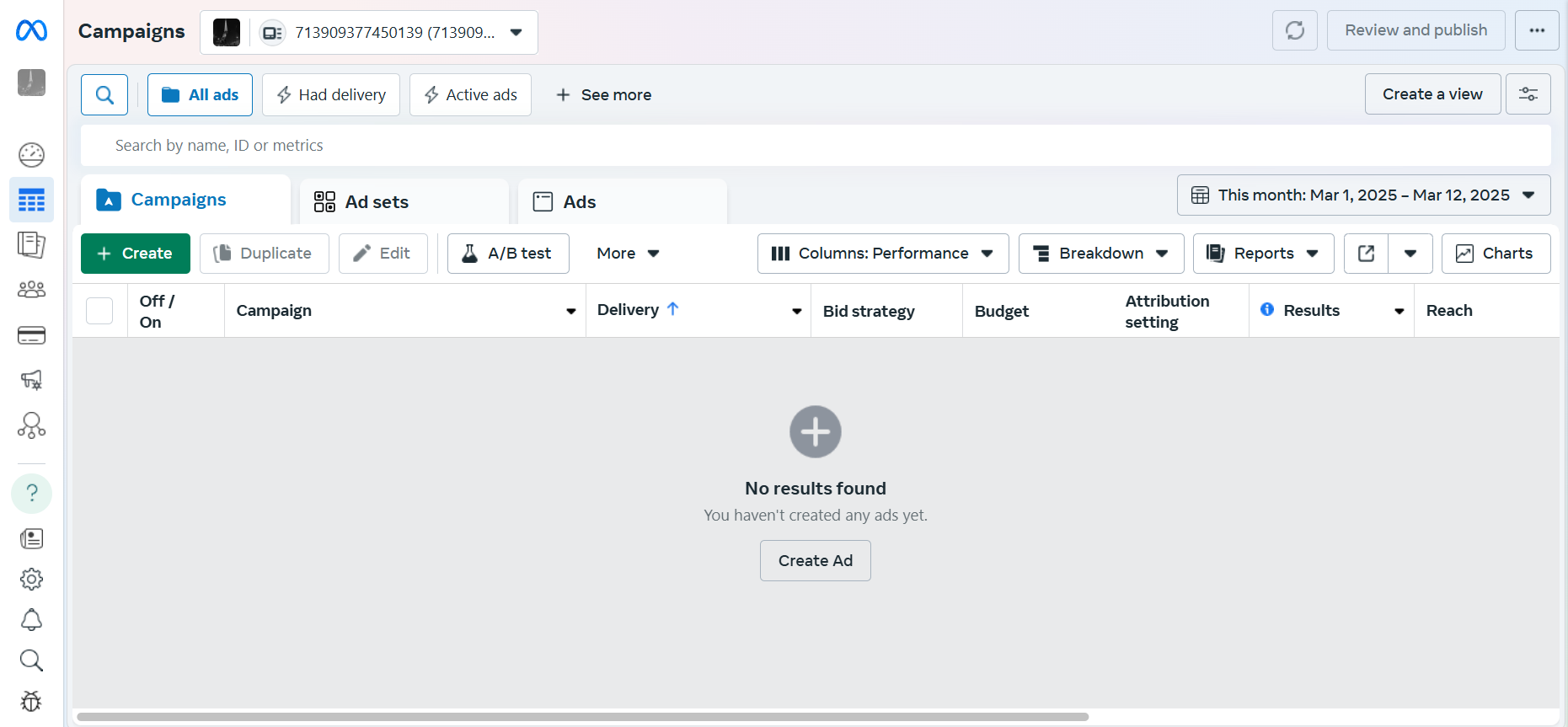

- Targeted Social Media Ads: Use platforms like Facebook, Instagram, and LinkedIn to run ads.

Meta Ads Manager’s Dashboard. These platforms allow you to target specific groups, such as young families or small business owners.

- Email Marketing: Send regular emails to your subscribers with helpful tips, updates, and offers. For example, you could share a guide on “5 Things to Know Before Buying Car Insurance.”

By using these strategies, you can reach a wider audience and turn leads into loyal customers.

-

Personalize Your Approach

Today’s customers expect personalized experiences.

They want to feel like you understand their unique needs and concerns.

Here’s how you can customize your marketing for insurance to meet these expectations:

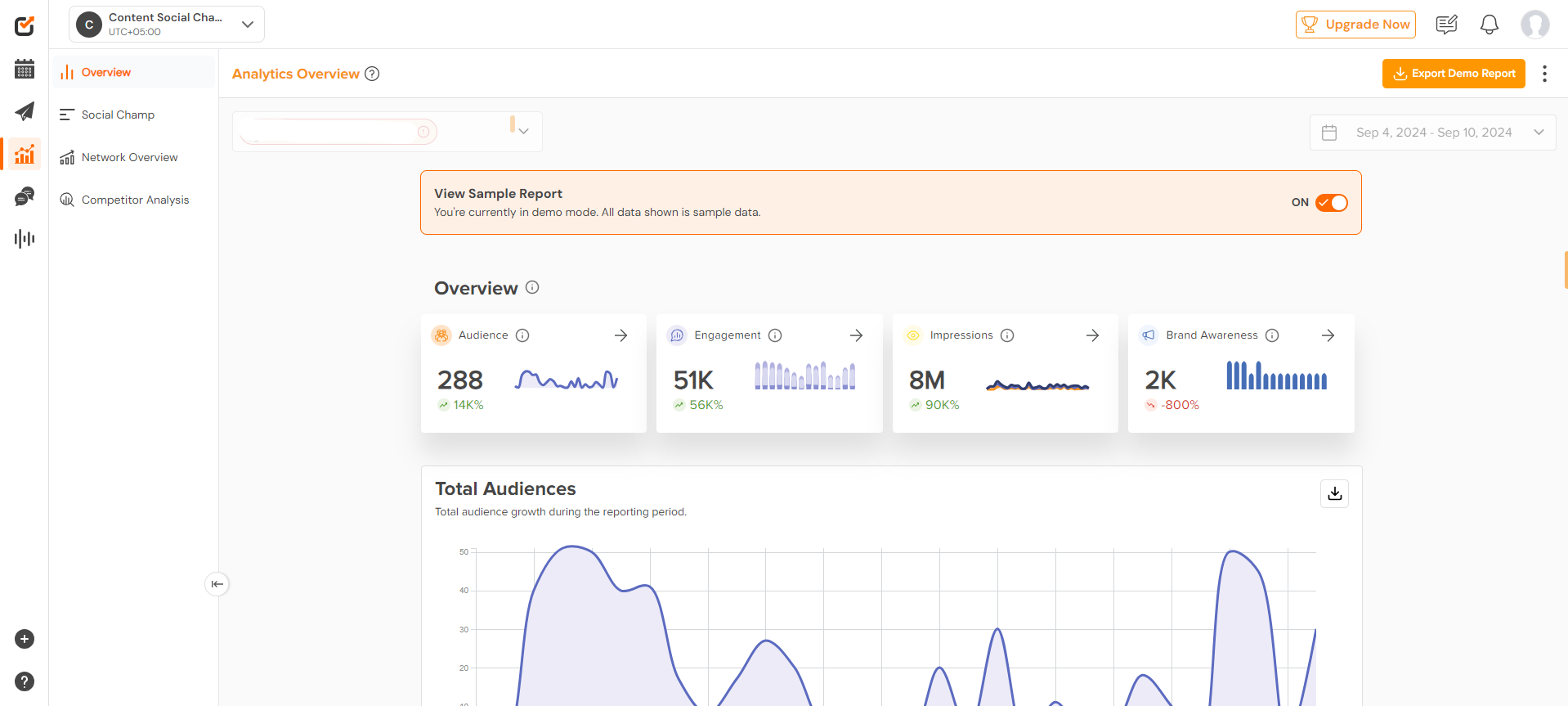

- Use Data Analytics: Analyze customer data to understand their preferences. For example, if someone frequently visits your life insurance page, send them related content or offers. Social Champ analytics provides in-depth insights on customers and much more.

Social Champ’s Analytics - Create Customized Solutions: Offer policies that match their specific needs. For instance, a young parent might need a family health plan, while a retiree may look for Medicare options.

- Personalized Communication: Address customers by their names and send messages that feel personal. For example, “Hi John, we noticed you were looking at car insurance. Here’s a special offer for you!”

Personalization builds trust and makes customers more likely to choose your services.

- Use Data Analytics: Analyze customer data to understand their preferences. For example, if someone frequently visits your life insurance page, send them related content or offers. Social Champ analytics provides in-depth insights on customers and much more.

-

Focus on Content Marketing

Content marketing is one of the most powerful techniques in insurance marketing.

It helps you educate your audience, build trust, and establish your brand as an authority.

Here’s how you can use content marketing effectively:

- Blogs: Write articles that explain complex topics in simple terms. For example, “What is Term Insurance?” or “How to Save Money on Home Insurance.”

- Videos: Create short, engaging videos that answer common questions. For instance, a video on “5 Mistakes to Avoid When Buying Insurance” can be very helpful.

- Infographics: Use visuals to explain data or processes.For example, an infographic on “How Insurance Claims Work” can make the process easier to understand.

By providing valuable content, you position your brand as a trusted resource.

This not only attracts potential clients but also keeps them coming back for more.

-

Leverage Social Media

Social media is a powerful tool for marketing insurance.

It allows you to connect with your audience, share valuable information, and build a loyal community.

Here’s how you can make the most of social media:

- Share Tips and Advice: Post helpful tips like “How to Lower Your Car Insurance Premiums” or “What to Look for in a Health Plan.”

- Showcase Success Stories: Share testimonials or case studies from happy clients. For example, “How We Helped Sarah Save $500 on Her Home Insurance.”

- Engage With Your Audience: Respond to comments, answer questions, and join conversations . This shows that you care about your customers and are ready to help.

Platforms like Facebook and LinkedIn are especially effective for reaching potential clients.

Alt Text: LinkedIn’s News Feed

You can build a strong online community around your brand by maintaining an active presence.

-

Use Automation Tools

Automation can save you time and make your insurance marketing efforts more efficient.

Here’s how you can use automation tools:

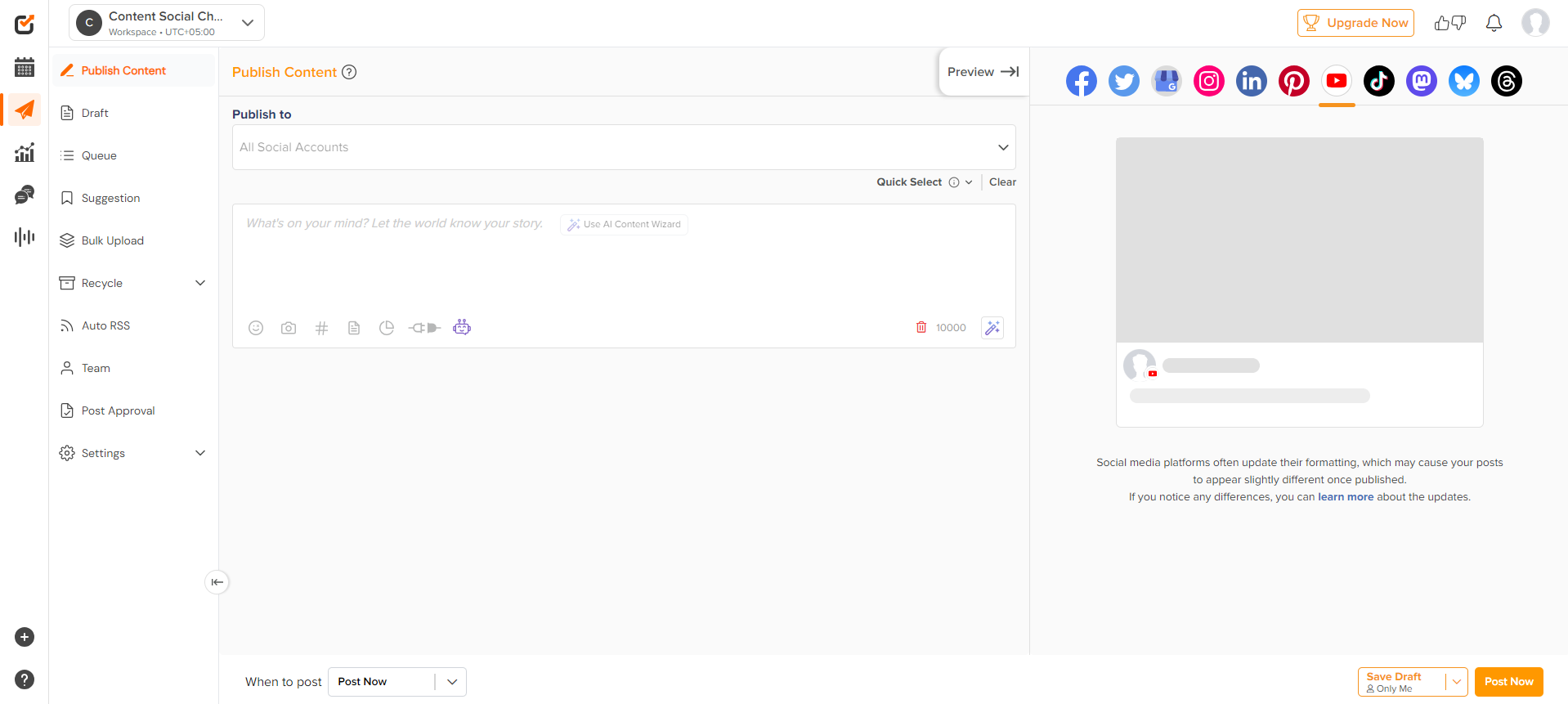

- Schedule Social Media Posts: Tools like Social Champ or Buffer let you plan and schedule posts in advance.This ensures your social media accounts stay active even when you’re busy.

- Automate Email Campaigns: Send personalized emails automatically based on customer actions. For example, if someone downloads a guide, you can send a follow-up email with related offers.

- Chatbots: Use chatbots on your website to answer common questions instantly. This improves customer experience and frees up your team’s time.

By automating repetitive tasks, you can focus on creating better strategies and building relationships.

-

Build Trust Through Transparency

Trust is crucial in the insurance industry.

Customers need to feel confident you’ll be there when they need you.

Here’s how you can build trust through your marketing for insurance:

- Be Transparent: Clearly explain your policies, pricing, and terms. Avoid using jargon or hiding important details.

- Share Reviews and Testimonials: Let your happy customers speak for you. Positive reviews can reassure potential clients and build credibility.

- Offer Free Resources: Provide free guides, calculators, or consultations. This shows that you’re here to help, not just sell.

When customers trust your brand, they’re more likely to choose you and stay loyal.

Featured Article: AI Marketing in 2025: Strategies, Tools, Trends, and Future Predictions for Business Growth

Leveraging Technology & Automation in Insurance Marketing

Technology is changing the way insurance companies market their services.

It’s making insurance marketing faster, smarter, and more effective.

By using the right tools, you can save time, improve customer experiences, and grow your business.

Let’s explore how technology and automation can transform your marketing for insurance.

How Technology is Revolutionizing Insurance Marketing

Modern tools are making insurance marketing more efficient and effective.

Here’s how:

- AI-Powered Tools: Artificial Intelligence (AI) can analyze customer data to predict their needs. For example, if a customer frequently searches for car insurance, AI can suggest relevant policies. This helps you offer personalized solutions that match their needs.

- Automation: Repetitive tasks like sending emails or tracking leads can be automated.

- This saves time and allows your team to focus on more important tasks. For instance, automated email campaigns can send follow-ups to potential clients without manual effort.

- Chatbots: Chatbots are AI-powered tools that can answer customer questions instantly . For example, if someone asks, “What’s the cost of life insurance?” the chatbot can provide an immediate response. This improves customer satisfaction and keeps them engaged.

- Social Media Management Tools: Platforms like Social Champ let you schedule posts and track engagement. You can plan your content and see how well it’s performing. This helps you stay active on social media without spending hours every day.

Social Champ’s Dashboard By embracing these technologies, you can update your insurance marketing efforts.

This improves efficiency and ensures a smooth and seamless experience for your customers.

Benefits of Using Technology in Insurance Marketing

Here are some key benefits of leveraging technology:

- Saves Time: Automation handles repetitive tasks, freeing up your team for strategic work.

- Improves Personalization: AI helps you understand customer needs and offer customized solutions.

- Enhances Customer Experience: Tools like chatbots provide instant support, making customers feel valued.

- Boosts Engagement: Social media tools help you stay active and connect with your audience regularly.

In short, technology is a game-changer for insurance marketing.

It helps you work smarter, not harder, while delivering better results.

Building Trust & Ensuring Compliance in Insurance Marketing

Trust is the foundation of any successful insurance marketing strategy.

Customers need to feel confident that you’ll protect their interests and deliver on your promises.

At the same time, you must follow industry rules to maintain credibility.

Here’s how you can build trust and ensure compliance in your marketing for insurance.

How to Build Trust With Your Customers

Trust is crucial in the insurance industry.

Here are some ways to earn and maintain it:

- Be Transparent: Always be clear about your policies, pricing, and terms. Avoid using complicated language or hiding important details. For example, explain what’s covered and what’s not in simple terms.

- Share Client Testimonials: Let your happy customers speak for you. Share stories of how you’ve helped them during tough times. For instance, “How We Helped John Recover After a Car Accident” can build credibility.

- Offer Free Resources: Provide guides, calculators, or consultations at no cost . This shows that you care about helping customers, not just selling policies.

- Be Responsive<: Answer customer questions quickly and professionally .Whether it’s through chatbots, emails, or phone calls, timely responses build trust.

When customers trust your brand, they’re more likely to choose you and stay loyal.

Ensuring Compliance in Insurance Marketing

The insurance industry is highly regulated, and your marketing efforts must follow the rules.

Here’s how to ensure compliance:

- Follow Data Privacy Laws: Protect customer data and use it responsibly. For example, don’t share personal information without permission.

- Avoid Misleading Claims: Be honest about what your policies offer. Don’t make promises you can’t keep, like “100% coverage for all accidents.”

- Stay Updated on Regulations: Insurance laws can change, so stay informed. For instance, new rules might affect how you advertise or communicate with clients.

By following these guidelines, you can avoid legal issues and maintain your reputation.

Why Trust and Compliance Matter

Building trust and ensuring compliance are essential for long-term success.

Here’s why:

- Customer Loyalty: Trustworthy brands earn loyal customers who stay for years.

- Positive Reputation: Ethical practices help you build a strong reputation in the industry.

- Legal Safety: Compliance protects your business from fines or legal troubles.

In summary, trust and compliance are the pillars of effective insurance marketing.

By focusing on transparency, honesty, and ethical practices, you can build a brand that customers rely on and respect.

Is Your Insurance Marketing Falling Behind?

Automate posts, track performance, and engage clients effortlessly with Social Champ. Stay ahead in 2025!

Final Thoughts

Mastering insurance marketing requires a blend of creativity, technology, and strategy.

Personalized approaches, engaging content, and an active social media presence help you connect with your audience on a deeper level.

At the same time, building trust and ensuring compliance are essential for long-term success.

By being transparent, ethical, and customer-focused, you can create a brand that people rely on and trust.

Remember, insurance marketing isn’t just about selling policies—it’s about building relationships and delivering value.

With the right strategies and tools, you can attract new clients, retain existing ones, and grow your business in a competitive market.

So, take these insights, apply them to your marketing efforts, and watch your insurance business thrive.